Constellation Brands (STZ) is set to release its second-quarter fiscal 2026 earnings after the market closes today, October 6. Analysts are projecting a sharp decline in both earnings and sales this quarter due to persistent inflationary pressures that are changing consumers’ buying habits. Notably, Constellation Brands has missed Wall Street’s expectations in two of the past eight quarters, signaling ongoing challenges for the alcoholic beverage maker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Street expects Constellation Brands to report a 21.8% year-over-year drop in adjusted earnings to $3.38 per share. At the same time, sales are estimated to fall 15% to $2.48 billion compared to the same period last year.

Analyst Insights Ahead of Results

In September, STZ cut its fiscal 2026 earnings per share (EPS) outlook from a range of $12.60 to $12.90 to a range of $11.30 to $11.60. Organic net sales are expected to fall between 4% and 6%, a sharp reversal from earlier projections of a potential 1% gain.

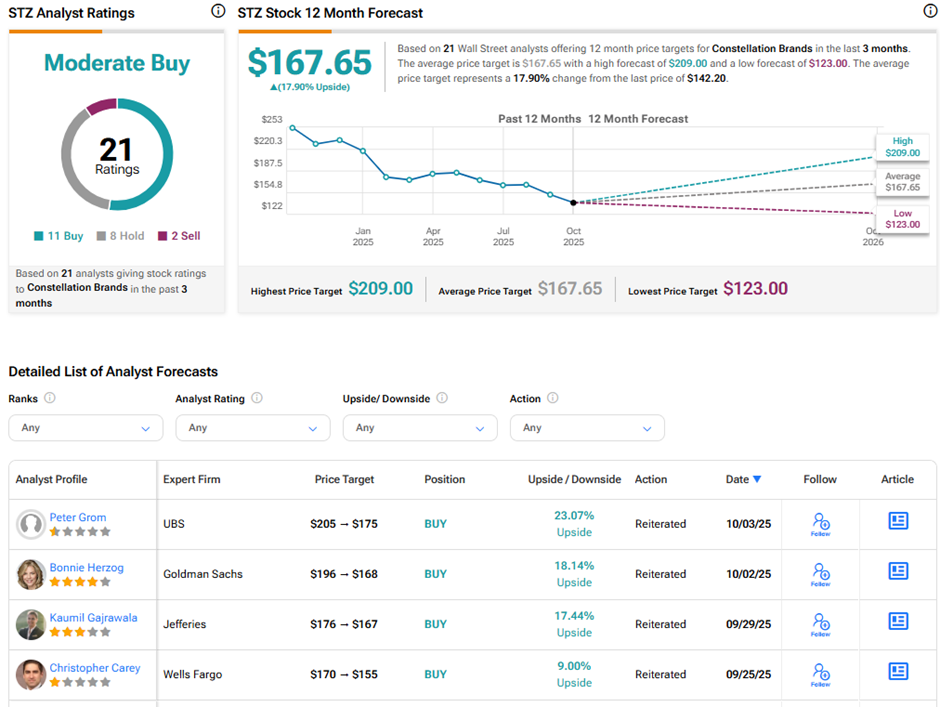

While analysts maintain “Buy” ratings on STZ, many have reduced their price targets after the company lowered its guidance.

UBS analyst Peter Grom cut his price target from $205 to $175, implying 23.1% upside potential. He believes that following the company’s downward revision, the Q2 results are “unlikely to prove to be a major catalyst.” Grom added that the downside is already priced in and sales could improve on easier comparisons in calendar year 2026.

Similarly, Goldman Sachs analyst Bonnie Herzog lowered her price target from $196 to $168, citing declining alcohol consumption trends. Her revised price target reflects 18.1% upside potential from current levels.

Also, Jefferies analyst Kaumil Gajrawala cut his price target from $176 to $167, implying 17.4% upside potential. Gajrawala highlighted multiple headwinds such as consumer spending slowdowns, poor weather, and weaker demand trends in North and South America.

Is STZ Stock a Buy, Hold, or Sell?

Wall Street remains cautiously optimistic about Constellation Brands’ long-term outlook. On TipRanks, STZ stock has a Moderate Buy consensus rating based on 11 Buys, eight Holds, and two Sell ratings. The average Constellation Brands price target of $167.65 implies 17.9% upside potential from current levels. Year-to-date, STZ stock has lost 34.5%.