Cisco (CSCO) has underperformed the S&P 500 (SPX) over the past 12 months and, interestingly, still trades below its dot-com peaks. The technology company might not seem as exciting as some of its peers, but there are notable tailwinds emanating from the artificial intelligence (AI) sector. Nonetheless, I’m concerned that the stock’s valuation metrics simply don’t add up. Consequently, I’m neutral on this company which was once so central to the creation of the internet.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Cisco Faces Challenges Despite Leading the Networking Market

Cisco Systems is a global leader in networking technology and has recently earned the attention of analysts due to potentially under-appreciated tailwinds from AI. Founded in 1984, Cisco has long been a cornerstone of internet infrastructure, providing routers, switches, and other networking equipment to businesses and organizations worldwide. However, the stock hasn’t been considered an appealing pick by investors in recent years.

Cisco Systems played a pivotal role in the internet’s early adoption, providing essential networking equipment like routers and modems, and this networking equipment segment continues to dominate, accounting for over half of revenue. Security solutions and collaboration software contribute 13% and 10.5%, respectively. Although Cisco has an established market position, especially in networking, challenges in sustaining market share have led to stagnant growth in recent years.

Cisco to Gain from AI Tailwinds

However, Citi (C) analyst Atif Malik recently upgraded Cisco to a Buy rating from Neutral (Hold), citing growing opportunities in AI. While AI currently accounts for only about 2% of Cisco’s revenue, Malik sees potential for a stronger contribution going forward. The analyst raised the price target for CSCO stock to $62 from $52 and increased earnings estimates for Fiscal 2025 and 2026.

Cisco’s inclusion in Meta’s (META) AI hardware portfolio, particularly its new AI network fabric called Disaggregated Scheduled Fabric, is seen as a positive validation of the company’s technology. This development could serve as a catalyst for CSCO stock, especially with upcoming quarterly results due in November.

Can Cisco Justify its Valuation?

However, even with these AI tailwinds, I struggle to see how Cisco can justify its valuation. The company is currently trading at 15.8x forward earnings, representing a 34.4% discount to the information technology sector as a whole.

That sounds great, but the company isn’t growing as fast as many of its peers in this sector, especially those at the forefront of AI and data centers. Cisco is expected to grow earnings at just 3.99% annually over the next three to five years – that’s not fast by any standards.

In turn, this results in a price-to-earnings-to-growth (PEG) ratio of 3.98. The PEG ratio is calculated by dividing the forward PE (price to earnings) ratio by the expected earnings growth rate for the medium term. Normally, a PEG ratio under one indicates that a company is trading at attractive levels.

The Cisco Dividend

However, the PEG ratio doesn’t take into account dividend payments. Cisco isn’t a big dividend payer – it has a forward yield of 2.83%, which is not very compelling, especially for a UK-based investor like myself. I also don’t believe it’s enough to account for the rather expensive PEG ratio.

Cisco’s Earnings Preview

Of course, near-term performance can have a major impact on the share price and how a stock is perceived by the market. For the upcoming quarterly results in November, analysts are estimating normalized earnings per share (EPS) of $0.87 and GAAP EPS of $0.44, with revenue expected to reach $13.77 billion.

In the last 90 days, there have been 15 upward revisions and four downward revisions to earnings estimates, indicating a generally positive outlook among analysts.

Looking back at the previous quarter’s (Q4 FY24) results, reported on August 14, Cisco beat expectations. The company reported EPS of $0.87, surpassing the consensus estimate of $0.85. Revenue for the quarter came in at $13.64 billion, slightly above the expected $13.53 billion.

Despite beating estimates, Cisco faced challenges in Q4 FY24. Revenue was down 10.3% year-over-year, reflecting ongoing market pressures. This adds a further layer of complexity and highlights that things aren’t moving in the right direction for Cisco.

Is CSCO Stock a Buy, According to Analysts?

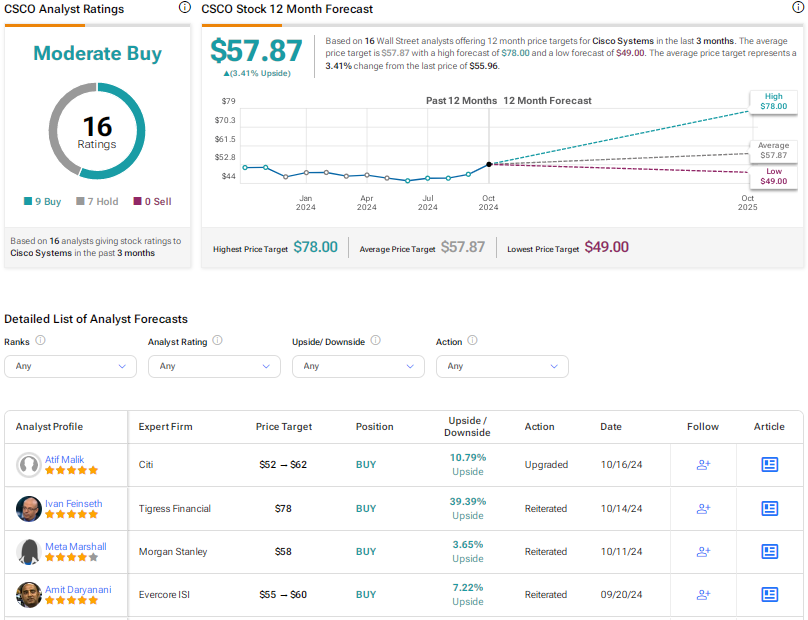

On TipRanks, CSCO is a Moderate Buy based on nine Buys, seven Holds, and zero Sell ratings assigned by Wall Street analysts in the past three months. The average Cisco Systems stock price target is $57.87, implying a modest upside potential of 3.4% from the current levels.

The Bottom Line on Cisco Systems

Cisco isn’t as exciting as many of its peers in the information technology sector. Its focus on networking equipment has meant it hasn’t seen the type of growth that many of its more AI-oriented peers have, and despite some positive comments from Citi, earnings growth isn’t impressive. Moreover, the company is starting to look expensive, and this is highlighted by the 3.98 PEG ratio. For these reasons, I prefer to stay on the sidelines on CSCO stock.