Investors may want to consider taking a stake in Chewy (CHWY) stock ahead of the pet supply company’s earnings report next week. At least, that’s what Baird analysts argue in a recent research note to clients. The firm has an Outperform rating and a $40 price target for CHWY stock, representing a potential 21.07% upside.

According to these analysts, Chewy stock’s recent price drop represents a good buying opportunity for investors. CHWY stock is down 1.34% year-to-date and is falling another 0.42% in pre-market trading on Tuesday.

Baird’s CHWY Stock Recommendation Rationale

Baird analysts keep Chewy as a “2025 best idea” for a variety of reasons. That includes the resilience the pet supply sector offers. That’s doubly important as investors weigh stocks carefully due to inflation and the ongoing trade war. The analysts argue that Chewy doesn’t have as much exposure to tariffs.

In addition, the Baird analysts claim Chewy has the potential to further grow its top line and expand 2025 margins. This comes as the industry settles and Chewy invests more in marketing. Its strong recurring revenue also makes it a strong competitor in the sector.

Chewy is expected to report its Q4 2024 earnings report before markets open on March 26. Wall Street expects the pet supply company to report earnings per share of 3 cents alongside revenue of $3.19 billion. Chewy has beaten EPS estimates in seven of the last nine quarters.

Is CHWY Stock a Buy, Sell, or Hold?

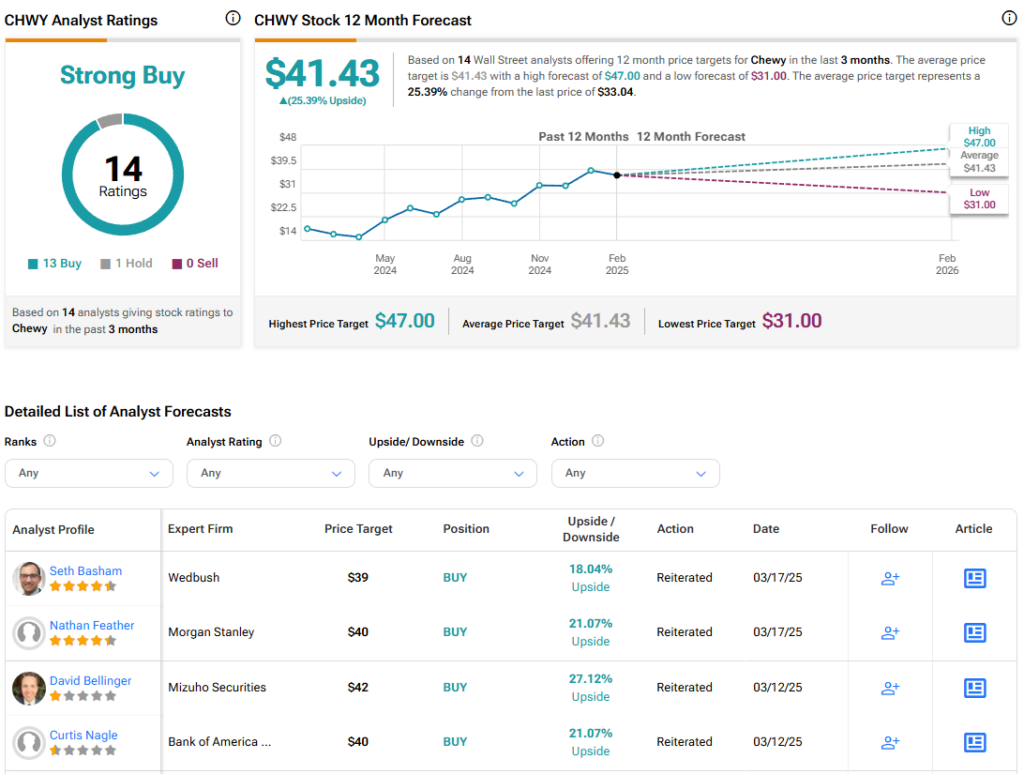

Turning to Wall Street, the analysts’ consensus rating for Chewy is Strong Buy based on 13 Buy and one Hold ratings over the last three months. With that comes an average price target of $41.43, a high of $47, and a low of $31. This represents a potential 25.39% upside for CHWY stock.

See more CHWY stock analyst ratings

Questions or Comments about the article? Write to editor@tipranks.com