Broadcom (AVGO) shares have been climbing after the company reported record Q3 revenues amid rising demand for its AI-focused chips. While Nvidia (NVDA) has long dominated the conversation around AI chips, four-star-rated analyst Ben Reitzes at Melius Research believes Broadcom could be the next big contender. The question now is whether Broadcom can truly follow in Nvidia’s footsteps.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Monday, AVGO stock jumped over 3%, extending its five-day rally to nearly 20%. The momentum was fueled by last week’s Q3 earnings report, where revenue surged 22% year-over-year to $15.95 billion.

Where Could Broadcom Dent Nvidia’s Dominance?

Alongside its stellar Q3 results, Broadcom disclosed a $10 billion order for new AI chips from an unnamed customer. While the company kept the buyer’s identity under wraps, market reports pointed to OpenAI as the customer of the deal.

Consequently, Reitzes believes that Nvidia’s dominance in AI compute would gradually shrink, with Broadcom capturing about 30% of the market and rivals like Advanced Micro Devices (AMD) taking at least 10%. He also highlighted Broadcom among the so-called “Magnificent 8” tech giants, arguing that the stock still has significant room to climb.

Notably, Reitzes reiterated his Buy ratings on both NVDA at a $240 target and AVGO at a $415 target. He emphasized that the two chipmakers are well-positioned to be major winners in the AI computing and networking market.

Citi Analysts Weigh In

Additionally, Citi analysts noted that Broadcom’s growing commitments from major clients could translate into a $12 billion revenue hit for Nvidia by 2026. Notably, many of these clients are also Nvidia customers.

Following Broadcom’s results, Citi’s five-star-rated analyst Christopher Danely raised his price target on AVGO stock from $315 to $350 while maintaining a Buy rating. In contrast, Citi’s top-ranked analyst Atif Malik trimmed his NVDA stock price target from $210 to $200, citing potential risks to Nvidia’s long-term sales trajectory.

Is Broadcom a Buy Stock?

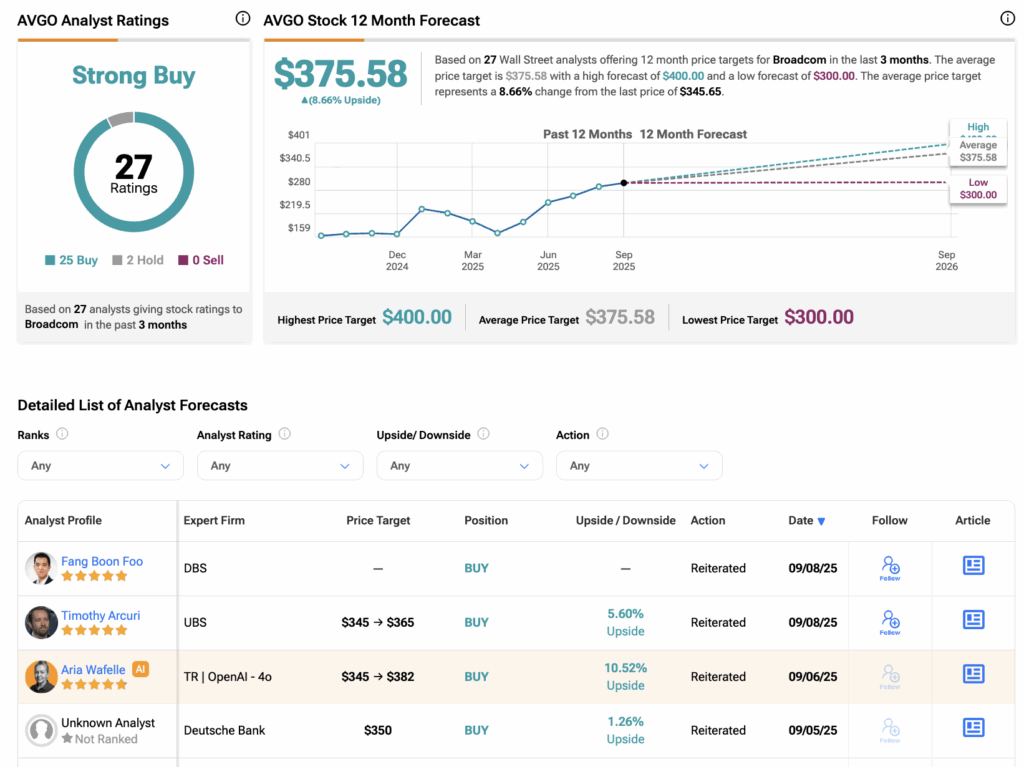

Turning to Wall Street, analysts have a Strong Buy consensus rating on AVGO stock based on 25 Buys and two Holds assigned in the past three months. The average Broadcom stock price target of $375.58 per shar, which implies an upside of 8.6% from current levels.