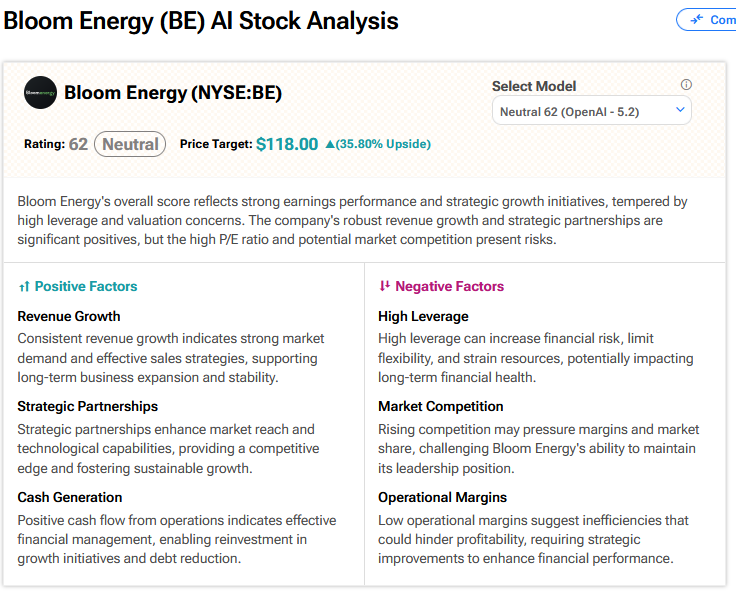

Bloom Energy (BE) stock has earned a Neutral rating from the TipRanks’ A.I. Stock Analysis tool.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

The tool assigns BE stock a rating of 62. Meanwhile, the A.I. analyst assigns a price target of $118 to BE stock, implying an upside of 35.80% from the current levels.

For context, TipRanks’ A.I. Stock Analysis provides automated, data-backed evaluations of stocks across key metrics, offering users a clear and concise view of a stock’s potential.

Key Drivers

Bloom Energy’s overall stock score reflects strong earnings performance and strategic growth initiatives, tempered by high leverage and valuation concerns. The company’s robust revenue growth and strategic partnerships are significant positives, but the high P/E ratio and potential market competition present risks.

Our AI analyst said that BE’s consistent revenue growth indicates strong market demand and effective sales strategies, supporting long-term business expansion and stability. Its strategic partnerships enhance market reach and technological capabilities, providing a competitive edge and fostering sustainable growth.

Positive cash flow from its operations indicates “effective financial management, enabling reinvestment in growth initiatives and debt reduction.”

As you can see above, it is not all smooth sailing for the BE stock, with our AI analyst declaring that its high leverage can increase financial risk, limit flexibility, and strain resources, potentially impacting long-term financial health.

It added that rising competition may pressure margins and market share, challenging its ability to maintain its leadership position. Low operational margins suggest inefficiencies that could hinder profitability, requiring strategic improvements to enhance financial performance.

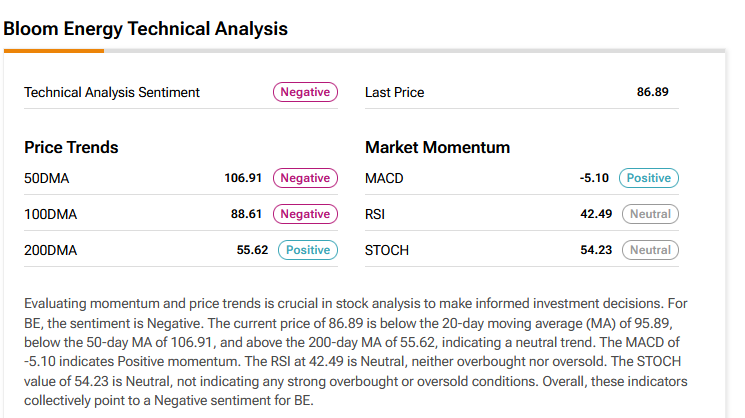

Technical indicators also look mixed – see below:

Is BE a Good Stock to Buy Now?

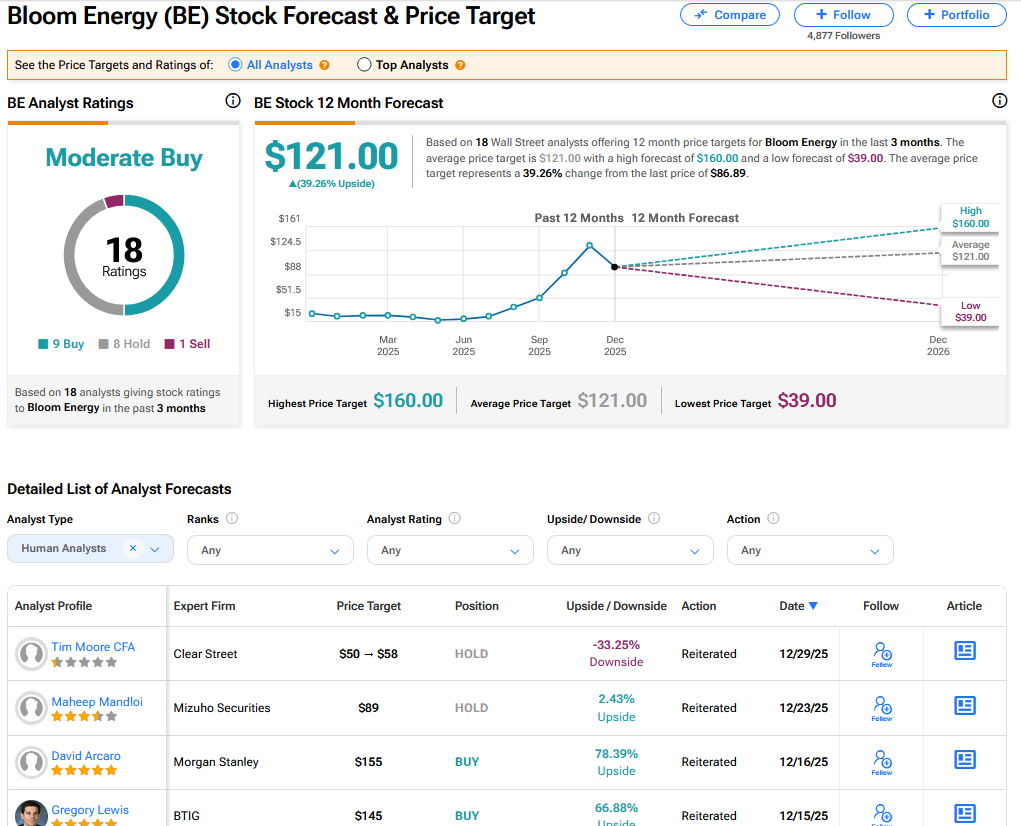

On TipRanks, BE has a Moderate Buy consensus based on 9 Buy, 8 Hold and 1 Sell ratings. Its highest price target is $160. BE stock’s consensus price target is $121, implying a 39.26% upside.