Payment giant Block (XYZ) is set to report its fourth-quarter earnings results on February 20 after the market closes. Analysts are expecting earnings per share to come in at $0.88 on revenue of $6.29 billion. This equates to 95.6% and 9% year-over-year increases, respectively, according to TipRanks’ data.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This is ideal because earnings per share should grow faster than revenue as this demonstrates a high degree of operating and financial leverage in the business. However, it’s also worth noting that XYZ has a choppy record when it comes to beating earnings estimates, as it has only done so twice during the past four quarters.

Nevertheless, some analysts seem to have an optimistic outlook on Block. Indeed, TD Cowen increased its price target for Block from $95 to $115 per share and recommends buying the stock. The firm believes that the strong overall economic indicators will help Block’s payment business perform well in 2025. The firm also thinks that the current estimates for the fourth quarter are reasonable, so the focus will shift to Block’s guidance for Fiscal Year 2025, where TD Cowen doesn’t expect any major surprises in Block’s guidance.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 13.9% move in either direction.

What Is the Price Target for XYZ?

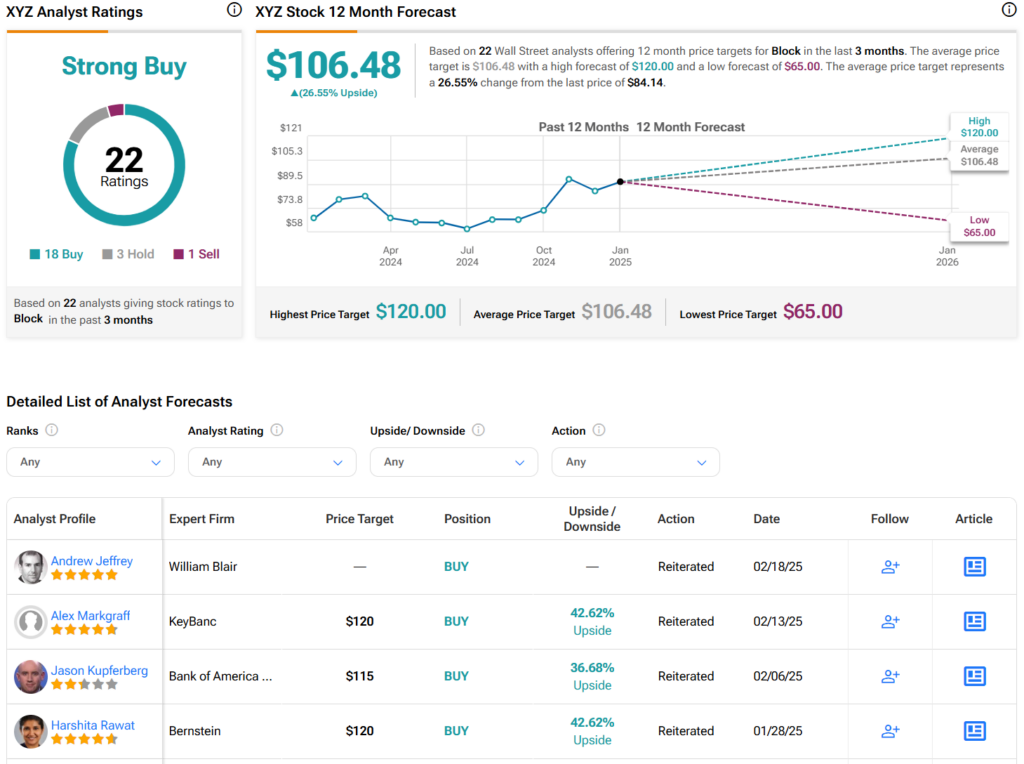

Overall, analysts have a Strong Buy consensus rating on XYZ stock based on 18 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 28% rally in its share price over the past year, the average XYZ price target of $106.48 per share implies 26.8% upside potential.