BigBear.ai (BBAI) is set to report its Q1 2025 earnings on May 1, 2025, after market close. Ahead of the results, BBAI stock gained about 6% in the pre-market trading session. It seems investors are optimistic about Q1 results due to the company’s efforts to expand its AI-powered decision intelligence solutions across the defense and enterprise sectors. Overall, Wall Street analysts remain moderately bullish on BBAI stock.

Currently, analysts expect BigBear.ai to report a loss of $0.06 per share for Q1, narrower than the loss of $0.67 in the same quarter last year. Also, analysts project first-quarter revenues at $36.26 million, reflecting a modest year-over-year increase of 9.5%.

AI Demand Drives BigBear.ai Growth

Analysts expect BigBear.ai to report steady revenue expansion, driven by higher demand for AI analytics in government and commercial sectors. During the quarter, the company expanded its AI-driven defense and intelligence solutions, securing new contracts in border security and national defense.

Also, collaborations with Amazon Web Services (AWS), Palantir (PLTR), and Autodesk (ADSK) helped strengthen its market position and broaden its AI applications. Further, the company’s focus on predictive analytics and AI-driven decision-making is expected to fuel long-term growth.

Overall, these factors suggest positive momentum for BigBear.ai heading into its Q1 earnings report.

Here’s What Options Traders Anticipate

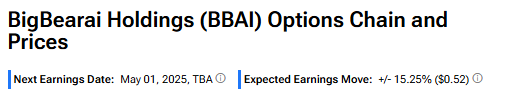

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 15.25% move in either direction in BigBear.ai stock in reaction to Q1 results.

Is BBAI a Good Stock to Buy Now?

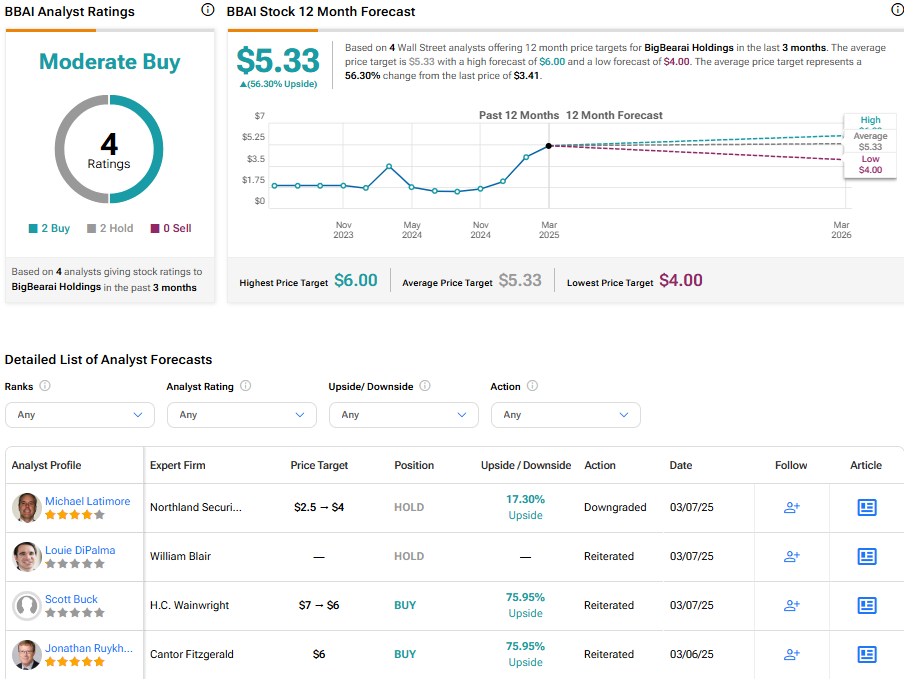

Turning to Wall Street, BBAI stock has a Moderate Buy consensus rating based on two Buys and two Holds assigned in the last three months. At $5.33, the average BigBear.ai price target implies a 56.3% upside potential. Shares of the company have gained 115.8% over the past six months.