Shares of Big Lots (NYSE: BIG) gained a whopping 15% on March 15, after the investment firm Mill Road Capital urged the company to hire a financial advisor and pursue a sale process of the company.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in Columbus, Ohio, Big Lots, Inc. is an American retail company with over 1,400 stores in 47 states. Shares of the company, with a current market capitalization of $1 billion, have lost 22% over the past six months.

Potential Sale at Attractive Valuation Premium

In a Form 13D letter filed with the SEC yesterday, Mill Road Capital disclosed that it has gained a 5.1% stake in the company based on its belief that Big Lots presents “an attractive investment opportunity”.

Not only has the major stakeholder proposed a sale of the company, but it has also recommended a valuation range between $55 and $70 per share.

The proposed valuations represent a premium of 72% to 119% to Big Lots stock’s closing price on March 14 of $31.99.

In the letter, the investment firm applauded the management team for its successful implementation of strategic initiatives. However, the letter added, “The current public valuation ignores recent improvement and positive long-term outlook”. Likewise, the firm reasserted that the board should consider a sale of the company to maximize shareholders’ value.

Interestingly, this is not the first time that Big Lots has been pursued. Earlier, in April 2020, Apollo Global Management (NYSE: APO) also pursued Big Lots for a potential acquisition.

Mixed Q4 Earnings Came with Positive Long-term Outlook

On March 3, the discount retailer reported mixed Q4 results, with revenues exceeding analysts’ estimates and earnings falling short of Street’s expectations.

The quarterly miss was attributed to a tough January month as bad weather and the Omicron spike led to inventory delays in main areas affecting business profitability.

The company reported adjusted earnings of $1.75 per share, significantly lagging analysts’ expectations of $1.90 per share. Net sales of $1.73 billion, however, exceeded the consensus estimate of $1.72 billion.

Disappointingly, the company provided an outlook for the upcoming first quarter below analysts’ expectations.

For the first quarter, adjusted earnings are likely to range between $1.10 and $1.20 per share, lower than the consensus estimate that is pegged at $1.28 per share.

Positively, however, the company plans to open 50 net new stores in 2022 with a long-range incremental store goal of more than 500 stores.

The company also reaffirmed a long-term sales target of $8 to $10 billion coupled with a 6% to 8% operating margin.

BIG CEO, Bruce Thorn, stated, “In 2022, we will open over 50 net new stores, further roll out programs to drive merchandise productivity, and continue to improve our supply chain infrastructure to enable us to serve our customers how, when and where they want to shop.”

Wall Street’s Take

Following the potential sale news, Bank of America Securities analyst Jason Haas CFA reiterated a Sell rating on the shares with the price target of $31 (16.1% downside potential).

According to the analyst, Mill Road valuations for Big Lots shares “looks optimistic”.

Turning to Wall Street, the analyst consensus is a Moderate Sell rating based on One Buy, Three Holds and Four Sells. The average Big Lots price target of $38.88 indicates an upside potential of 5.3%.

Investors Weigh In

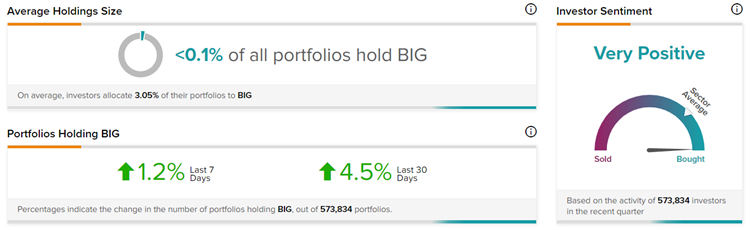

Positively, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Big Lots, with 4.5% of investors increasing their exposure to BIG stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AVEO Oncology Shares Gain 21.4% on Upbeat FOTIVDA Revenues & Outlook

Coupa Software Plunges Over 30% on Bleak FY2023 Outlook

Cano Health Shares Soar 8% After-Hours Despite Q4 Miss