British drugmaker AstraZeneca (AZN), fresh off a record-high stock price, continues to draw interest from U.S. and European investors thanks to, among others, its plan to start trading directly in New York from February 2, 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The move marks a significant pivot to the U.S., which is the company’s largest market. However, while AstraZeneca’s recent drug discount deal with the Trump administration in exchange for tariff exemption is seen as a lever to support its U.S. growth, a slight impact on its core gross margin is also expected from the move.

This raises the question of whether AZN stock makes for a good investment right now, even as the British drugmaker, like other top British pharma companies, remains enmeshed in a drug price row with the British government. It even recently paused its planned £200 million (currently about $265 million) investment in Cambridge.

How Is AstraZeneca’s Stock Doing?

Amid its U.K. troubles and the doubling down of its U.S. investment — the company in early October kicked off construction of a $4.5 billion plant in Virginia as part of its plan to invest $50 billion in the country — AstraZeneca continues to outdo many of its competitors.

Although AstraZeneca’s share price is marginally down today to $92.60 as of 8:30 a.m. EST, its current share price is trading closer to its 52-week high of $94.02. It closed Friday at $93.72, which is a far cry from its one-year low of $61.24.

The current fractional fall comes as pharma companies continue to enter discount price arrangements with the Trump administration, with Danish pharma heavyweight Novo Nordisk (NVO) joining the bandwagon last week. The drop ignores the U.S. health regulator’s approval of AstraZeneca’s Imfinzi cancer drug for the treatment of — in combination with chemotherapy — certain early-stage stomach and food-pipe cancers in adults.

AstraZeneca Outperforms Big Pharma Rivals

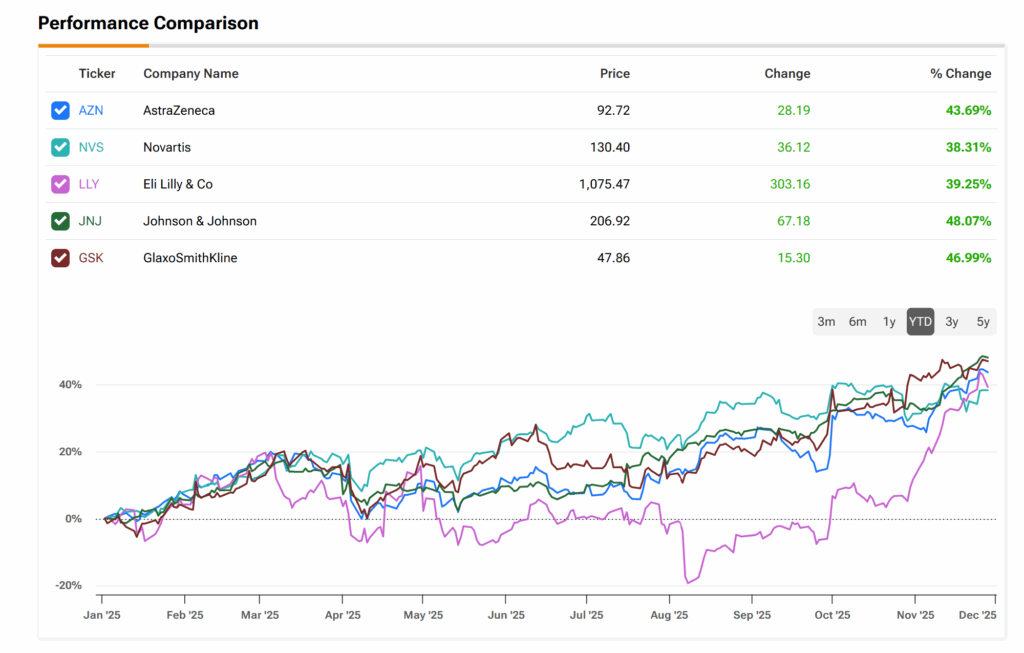

However, compared to its rivals, AstraZeneca’s stock price jump since January 2025 hands down beats many of its rivals, such as Pfizer (PFE), Merck & Company (MRK), Bristol-Myers Squibb (BMY), Roche (RHHBY), and Sanofi (SNY). See the chart below.

As the additional image below shows, AZN stock’s year-to-date performance also exceeds that of Swiss pharma giant Novartis (NVS) and U.S.-based rival Eli Lilly (LLY), only slightly outpaced by Johnson & Johnson (JNJ) and GlaxoSmithKline (GSK).

Bulls Cheer AstraZeneca’s Drug Portfolio, Valuation

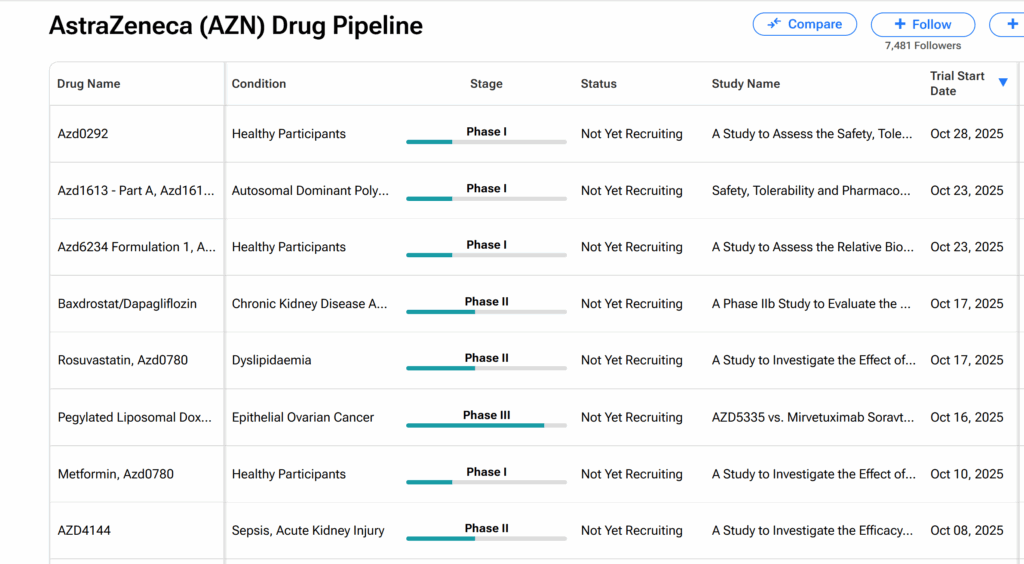

Wall Street is generally bullish on AZN stock. At the moment, analysts are pointing to the potential for AstraZeneca to launch its high blood pressure drug Baxdrostat in the U.S. This came after late-stage clinical trials showed that the drug stays in the body for 24 hours, keeping blood pressure down, compared to the limited performance of rival medication Lorundrostat.

On top of these, AstraZeneca achieved 31 regulatory approvals and reported positive results from 16 Phase III trials during its recent third-quarter earnings results.

This adds to the success of its oncology segment, which is currently its biggest business division (see the chart below). The segment saw sales rise by 16% to $18.6 billion during Q3 2025.

The segment had seen record quarterly sales in the prior quarter, with growth fueled by sales of AstraZeneca’s lung cancer drug Tagrisso and chemotherapy drug Enhertu. The company also has several other drugs in development and at various stages of clinical trials.

BofA Securities analyst Sachin Jain and his team named AZN stock the institution’s top stock pick going into 2026. Jain cited AstraZeneca’s “big [drug] pipeline year” and “attractive” valuation, which he believes is trading sixteen times above the pharma giant’s expected earnings in 2027.

The BofA analyst raised his AZN price target by about 18% to $108.50, representing about 16% upside from the closing price of $93.24 on November 25.

Bears Warn on Cancer-Drug Pressure, China Troubles

On the other hand, bearish analysts point to rising risks to AstraZeneca’s key cancer franchises from generic manufacturers and headwinds facing the company in China.

Deutsche Bank analyst Emmanuel Papadakis, who recently downgraded AZN to Sell, argued that AstraZeneca has moved past the peak of its oncology growth story, which was driven by its portfolio of drugs targeting HER2 and TROP2, proteins manifest on the surface of certain cancer cells, particularly in breast cancer.

Papadakis had previously slammed a Hold rating on AstraZeneca’s shares over its “China episode.” A large share of AstraZeneca’s revenue in the emerging market comes from China, as the chart below shows. However, the Chinese government’s drug pricing regulations, COVID-19 lockdowns, and broader policy risks have been a source of headaches for investors.

Moreover, AstraZeneca’s trouble in securing approval from the British government for its new drugs and treatments, such as breast cancer medication Enhertu, is also a key area of concern for some bears.

AstraZeneca Ups Outlook, Tops Peers on Profit

Despite the challenges, AstraZeneca remains upbeat about its core earnings per share (EPS) and total revenue for the full Fiscal Year 2025. It anticipates the former to rise by a low double-digit percentage and the latter by a high single-digit.

This is even as the British pharma giant grew its Q3 2025 revenue by 12% year-over-year to $15.19 billion, and EPS by 14% to $1.19. Both metrics comfortably beat Wall Street estimates.

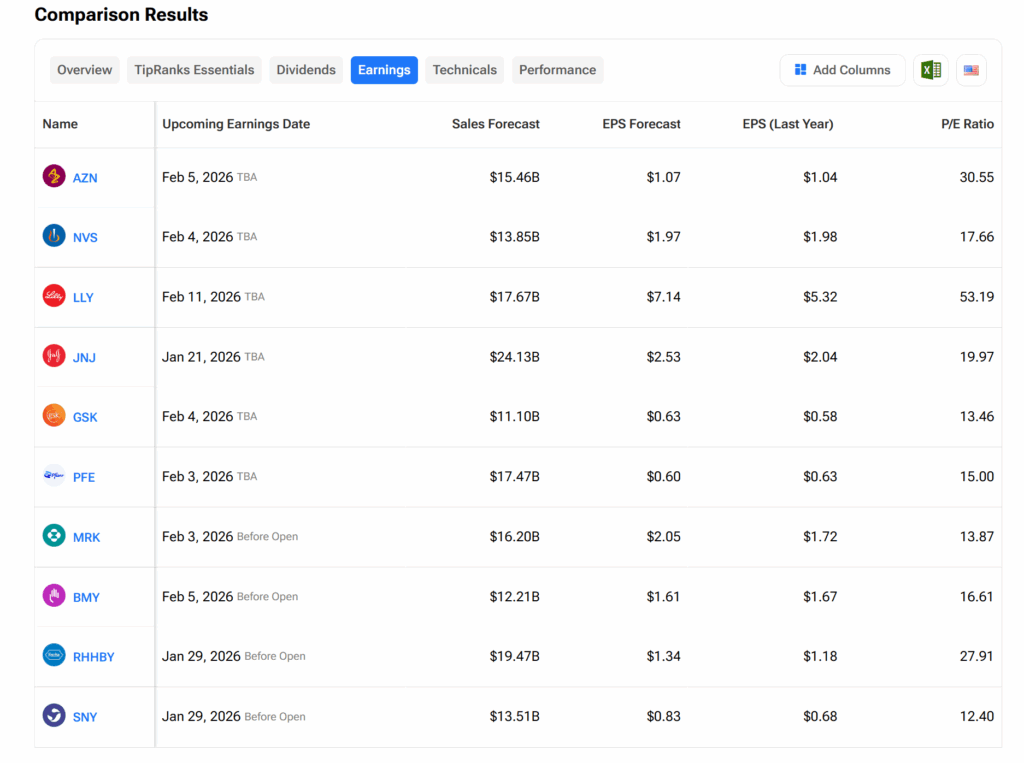

In addition, AstraZeneca continues to remain highly profitable, with its gross profit margin — the percentage of its earnings it keeps for itself after settling the direct cost of producing its products — currently standing at 82.89%. This compares much more favorably to its rivals’ margins. Johnson & Johnson’s currently stands at 67.87%, Pfizer at 64.29%, and GlaxoSmithKline at 72.89%.

However, at 1.69%, its dividend yield is modest and closer to the health sector average of 1.5% compared to its competitors’. For instance, Pfizer’s currently stands at 6.68% while Johnson & Johnson’s is 2.48%.

For further insight, the image below provides analysts’ sales and earnings forecasts for AstraZeneca and its rivals in their ongoing quarters.

So, Is AstraZeneca a Buy or Sell?

Analysts’ long-term forecast on AstraZeneca is very bullish. TipRanks’ data shows that AstraZeneca’s shares currently enjoy a Strong Buy consensus rating on Wall Street based on four Buys issued by analysts over the past three months.

However, at $93.67, the average AZN price target only implies a very modest 1.02% growth potential from the current trading levels.