Semiconductor company Applied Materials (AMAT) is set to report its third-quarter earnings on August 14 after the market closes. Wall Street is predicting earnings per share of $2.36 and revenue of around $7.22 billion. These estimates represent an increase from last year’s figures of $2.12 and $6.77 billion, respectively. However, some analysts are cautious about the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, although UBS, led by five-star analyst Timothy Arcuri, recently increased its price target for Applied Materials from $175 to $185, it maintained a Hold rating. The firm noted that it sees few surprises and expects third-quarter performance to come in slightly ahead of guidance. Similarly, five-star Barclays analyst Tom O’Malley raised his price target for Applied Materials from $160 to $170 and kept a Hold rating.

Barclays pointed to a favorable semiconductor capital equipment environment in the second half of 2025, which is supported by improving conditions in China. Interestingly, it is worth noting that Applied Materials earns most of its revenue from China, as illustrated in the image below. However, the firm believes that Wall Street’s 2026 estimates are still overly optimistic. As a result, it remains cautious and questions how the stock might perform once the stronger back half of 2025 is fully factored into investor expectations.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 5.6% move in either direction.

Is AMAT Stock a Buy?

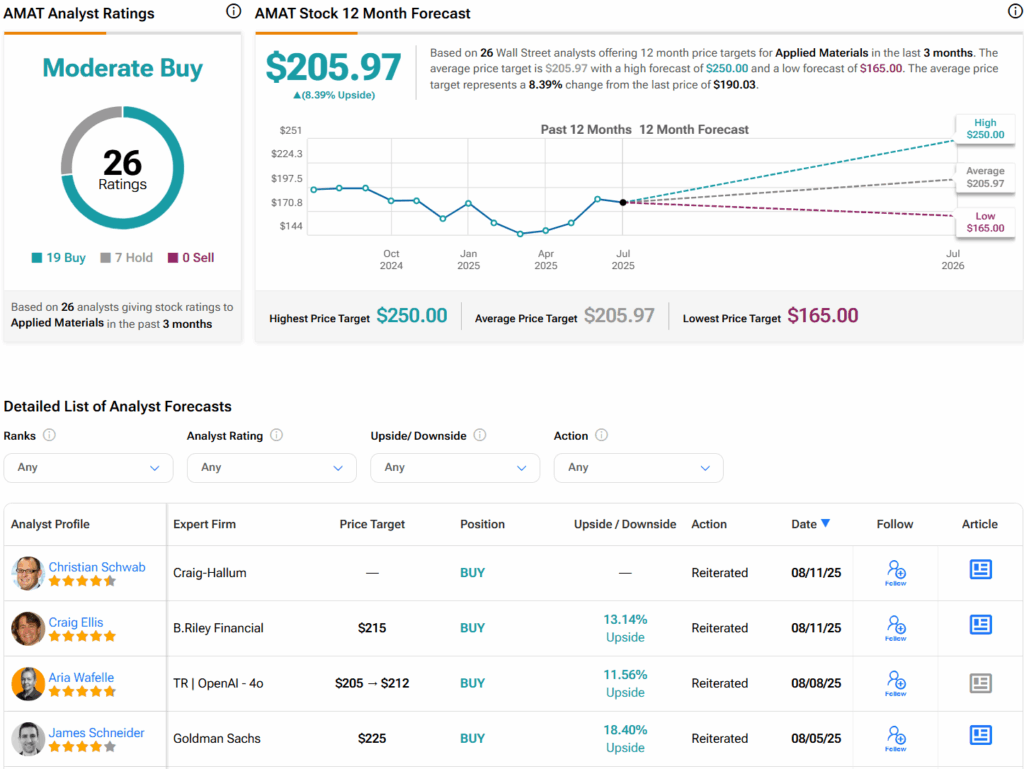

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMAT stock based on 19 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMAT price target of $205.97 per share implies 8.4% upside potential. At the same time, TipRanks’ AI analyst has an outperform rating with a $212 price target.