American Express (AXP) has outperformed most credit card stocks while presenting more upside for long-term investors, prompting me to be bullish. Rising profit margins, strong sales growth, and a young customer base are some of the catalysts that have resulted in a 34% year-to-date gain. While past results do not guarantee future success, American Express looks poised to reward long-term investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

American Express’ Customer Base Is Young

American Express’ ability to draw in younger customers is part of the reason why I am bullish on the stock. That young customer base makes it one of the best credit card stocks to own.

For example, the fintech firm reported an additional 3.4 million card acquisitions in the first quarter of 2024. American Express also mentioned that millennial and Gen Z consumers “accounted for more than 60% of new consumer account acquisitions globally.”

Moreover, that trend continued in Q2 2024 as the company reported 3.3 million new card acquisitions. American Express’ continued gains among Gen Z consumers should result in steady revenue growth for several years. In fact, one of the company’s reports indicates that Gen Z will be the largest consumer segment by 2030. Winning over this generation should result in higher long-term returns.

AXP Is Cheaper than Most Credit Card Stocks

American Express’ low P/E ratio is another reason why I am bullish on AXP stock. While Visa (V) and Mastercard (MA) have P/E ratios in the 30s, American Express stock only has a 19 P/E ratio.

Furthermore, a lower valuation gives American Express a greater margin of safety than the other credit card stocks. It’s maintained a better value proposition while outperforming its peers. While AXP stock has gained 34% year-to-date, Visa and Mastercard only have year-to-date gains of 11% and 16%, respectively.

However, it is important to note that some stocks have higher valuations because they post stronger financial growth rates, but that isn’t the case with these credit card stocks. American Express has been reporting higher net income growth rates than Visa and Mastercard for several quarters. For instance, American Express reported 39% year-over-year net income growth in Q2 2024. Meanwhile, Visa and Mastercard didn’t report net income growth rates above 20% during their most recent quarters.

The one edge Visa and Mastercard have over American Express is their higher profit margins. Visa regularly posts net profit margins above 50%, and Mastercard’s profit margins have been above 40% for several quarters. American Express only recently posted a 20% net profit margin in the second quarter.

Despite this difference, while Visa and Mastercard do a better job at retaining revenue, American Express’ profit margins continue to rise. AXP’s net profit margins increased by 27.5% year-over-year. The fintech firm has more room to expand its profit margins, which would result in elevated earnings.

Additionally, it’s much easier for American Express to go from a 20% net profit margin to a 30% net profit margin than it is for Visa to jump from a 55% net profit margin to a 60% net profit margin. This advantage makes American Express a more compelling pick than its competitors.

Dividend Investors Should Also Like AXP

A good dividend can help any stock, and it adds more fuel to my bullish stance on the stock. While Mastercard and Visa have yields below 0.8%, American Express is holding strong with a 1.11% yield. Furthermore, American Express has a double-digit annualized dividend growth rate, including a recent 17% dividend hike.

Meanwhile, Visa grew its dividend by 15.6% last year, while Mastercard raised its dividend by 15.8% year-over-year. While the differences between dividend growth rates are marginal, American Express offers a more respectable yield right from the start.

Most dividend growth stocks have low yields in exchange for high dividend growth rates. The idea behind this group of stocks is that you buy into solid companies and have high cash flow by the time you retire. While you can find stocks yielding much higher than 1.11%, it’s difficult to find stocks like AXP that offer strong financial growth plus a respectable yield.

Is American Express Stock a Buy?

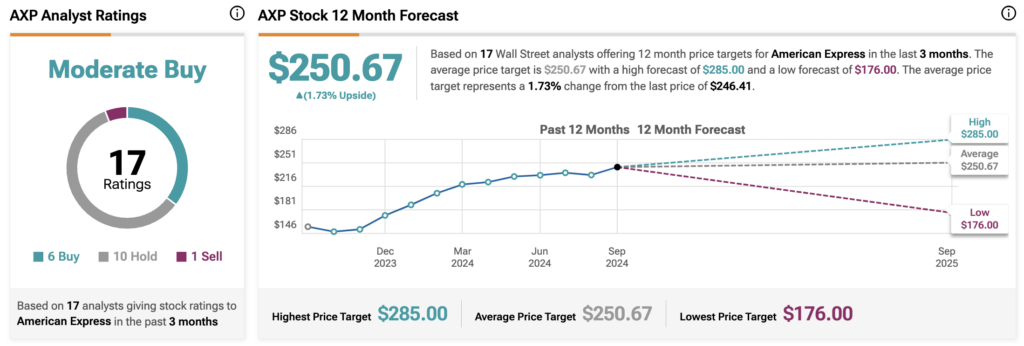

American Express is rated as a “Moderate Buy” among 17 analysts, with a projected downside of 0.4% from current levels. The stock has received six Buy ratings, 10 Hold ratings, and one Sell rating. The highest price target of $285 per share indicates that American Express stock could gain an additional 13%.

The Bottom Line on American Express Stock

In conclusion, American Express stock looks like it can reward long-term investors and outperform its peers, prompting me to be bullish on the stock. The credit card company trades at a reasonable valuation, attracts young customers, and continues to post rising profit margins.

Dividend investors will appreciate that the stock has maintained a double-digit dividend growth rate for several years while offering a 1.11% yield. More investors are noticing the opportunity, as evidenced by American Express outperforming the S&P 500 and Nasdaq Composite year-to-date. Continued consumer spending and card acquisitions should generate additional gains for investors.