AMD stock (AMD) fell on Thursday as investors digested the news that Nvidia (NVDA) will pour $5 billion into Intel (INTC) and work side-by-side with the chipmaker on custom processors. The deal instantly makes Nvidia one of Intel’s largest shareholders and showcases a big change in the balance of power across the semiconductor industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For AMD, this is bad timing. The company has spent the last several years clawing market share away from Intel in data centers and high-performance computing. But if Intel can leverage Nvidia’s AI momentum, it could revive its own struggling position while giving customers an alternative to AMD’s offerings.

The sell-off shows just how sensitive AMD’s stock is to competitive shocks. Investors are worried that Nvidia’s embrace of Intel may shut AMD out of key AI infrastructure deals and slow down its recent growth streak.

Nvidia’s Bet Puts AMD in the Crosshairs

The Intel-Nvidia partnership is designed to deliver multiple generations of data center and PC products. Intel will produce CPUs tailored for Nvidia’s AI platforms, while also building circuits that integrate Nvidia hardware into consumer and enterprise systems.

This directly overlaps with AMD’s core business. For years, AMD has positioned its CPUs and GPUs as the go-to choice for both PCs and data centers. Now, Nvidia and Intel are promising a pipeline of products that could challenge AMD in both areas simultaneously.

Analysts say AMD faces the risk of being boxed in. On one side, Nvidia remains dominant in AI accelerators. On the other, Intel now has Nvidia’s backing to rejuvenate its server and PC lineup. AMD’s stock drop reflects fears that it could become the odd one out in a market where scale and partnerships dictate who wins the biggest contracts.

What AMD Investors Should Think About

AMD’s long-term growth story isn’t broken, but the Nvidia-Intel deal has clearly rattled confidence. The company will now need to prove it can maintain its edge in innovation while also countering two giants working together.

For investors, the concern is whether AMD can continue to expand in cloud and AI markets at the same pace. If customers start to see Intel as a credible partner again, and Nvidia keeps feeding that credibility, AMD could find itself squeezed on margins and market share.

The stock’s decline today is less about immediate earnings and more about the long-term chessboard. Nvidia just moved one of its biggest pieces, and AMD is the player left under pressure to respond.

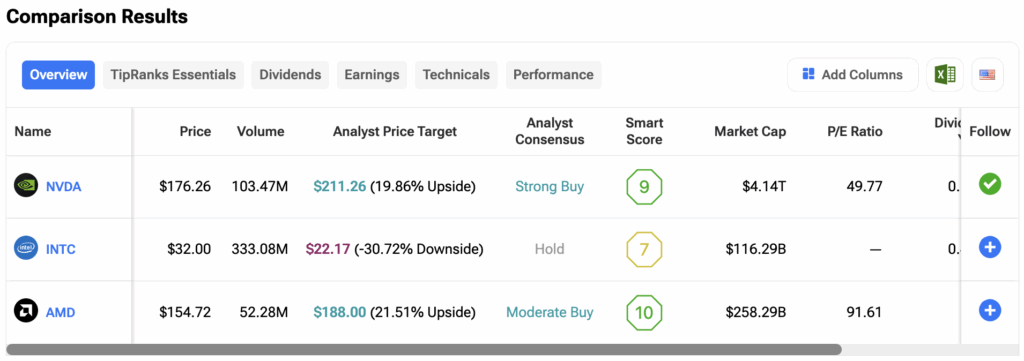

Investors can compare these stocks based on analyst ratings and various financial metrics on the TipRanks Stocks Comparison Tool. Click on the image below to explore the tool.