Alibaba Group (BABA) has been drawing renewed attention as investors weigh its turnaround efforts and growth in cloud and e-commerce. The company has been simplifying its operations and focusing more on its main businesses after a major reshuffle. Recently, Alibaba merged its food delivery app Ele.me and travel site Fliggy into its main e-commerce unit to streamline services and boost user reach. It’s also pushing deeper into AI and cloud services to stay competitive in China’s fast-changing tech space. Looking ahead, analysts remain bullish on the stock and expect an upside of around 45% from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

For context, Alibaba remains one of China’s top tech players, with a vast footprint in online retail, logistics, and cloud computing. The stock soared roughly 57% over the past year and 36.6% year-to-date. While near-term volatility could persist, especially amid weak consumer spending in China, many investors believe Alibaba’s size, market share, and cash flow strength make it a long-term contender.

What Are Analysts Saying About BABA Stock?

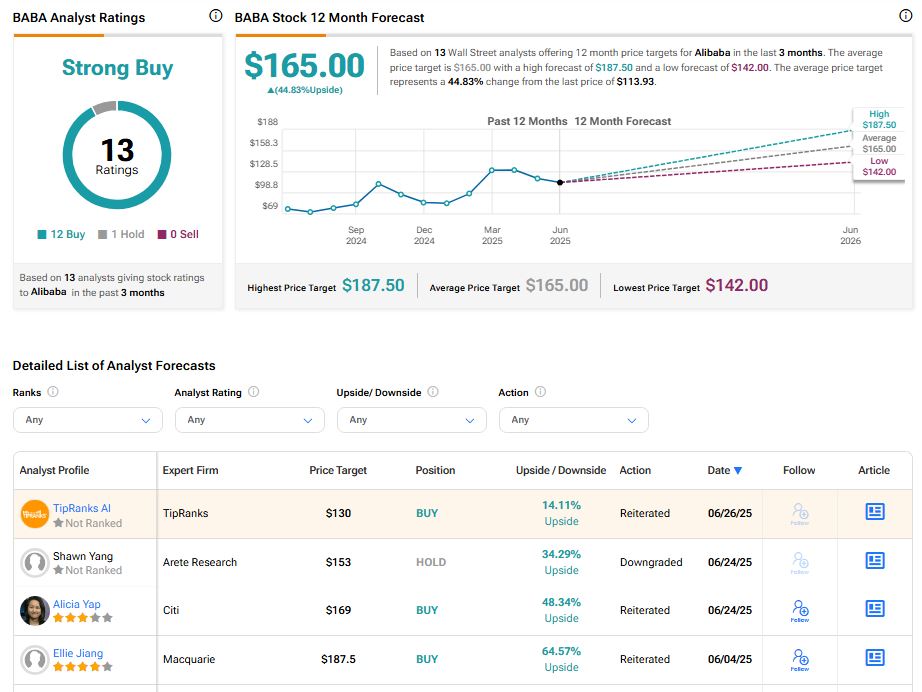

This week, Citigroup analyst Alicia Yap, who covers China’s internet and e-commerce space, reaffirmed her Buy rating on the stock with a $169 price target, implying nearly 48% upside from current levels. She expects strong core marketing revenue (CMR) growth in Q1 FY26, driven by strong results from the 6.18 shopping festival, combined with solid retail trends in April and May. She also pointed to promising signs from “Taobao Quick Commerce,” which has started to deliver positive results and could offer incremental growth opportunities across categories over time.

Meanwhile, Arete analyst Zixiao Yang downgraded Alibaba stock to Neutral from Buy with a $153 price target. Though the analyst remains cautious in the near term, the price targets suggests there’s still meaningful upside ahead for Alibaba as it works to regain momentum.

What Is the Price Target for Alibaba Stock?

Analysts remain highly bullish about Alibaba’s stock trajectory. With 12 Buy ratings and one Hold rating, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $165 implies about 45% upside potential from current levels.