Shares of iRobot (IRBT), best known for its Roomba vacuums, fell more than 30% on Monday after the company said its efforts to sell itself have stalled. More specifically, iRobot revealed in a filing that its last potential buyer backed out after months of exclusive negotiations. The company has been trying to find a buyer since March, but its future has been uncertain ever since Amazon (AMZN) dropped its $1.7 billion acquisition plan in January 2024 due to regulatory concerns.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Without the Amazon deal, iRobot has struggled to bring in enough cash and pay down its debts. Indeed, the firm even warned investors back in March that there is “substantial doubt” about its ability to remain in business. As a result, Amazon CEO Andy Jassy criticized regulators for blocking the deal by saying that it would have given iRobot the scale needed to compete with rivals that are expanding quickly in the robot vacuum market.

Nevertheless, on Monday, iRobot said that the last bidder’s offer was far below its recent stock value, and it has no other active talks for a sale or strategic partnership. It is worth noting that the company has been relying on a $200 million loan from Carlyle Group (CG) and recently extended its waiver on certain loan terms until December 1, which is the sixth amendment to the agreement. Moreover, iRobot warned that if it cannot secure more funding soon, it may have to sharply cut operations or consider bankruptcy protection.

Is IRBT a Good Buy?

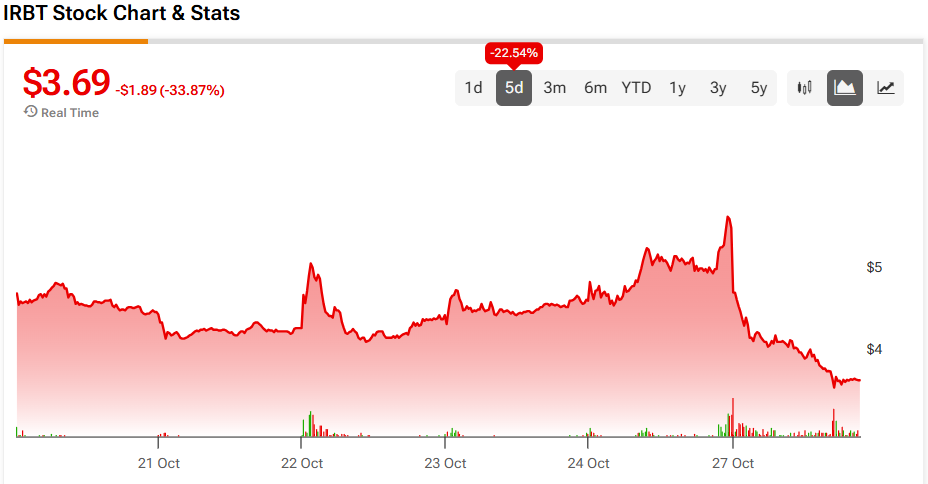

A look at the past five trading days for IRBT stock highlights the level of impact today’s news had on it. Indeed, investors are now down 22.5% during this timeframe.