Investors are preparing for market turbulence after the U.S. launched a military strike on Iranian nuclear sites. The move, announced by former President Donald Trump on Truth Social and described as a “spectacular military success,” adds new uncertainty to an already fragile global outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

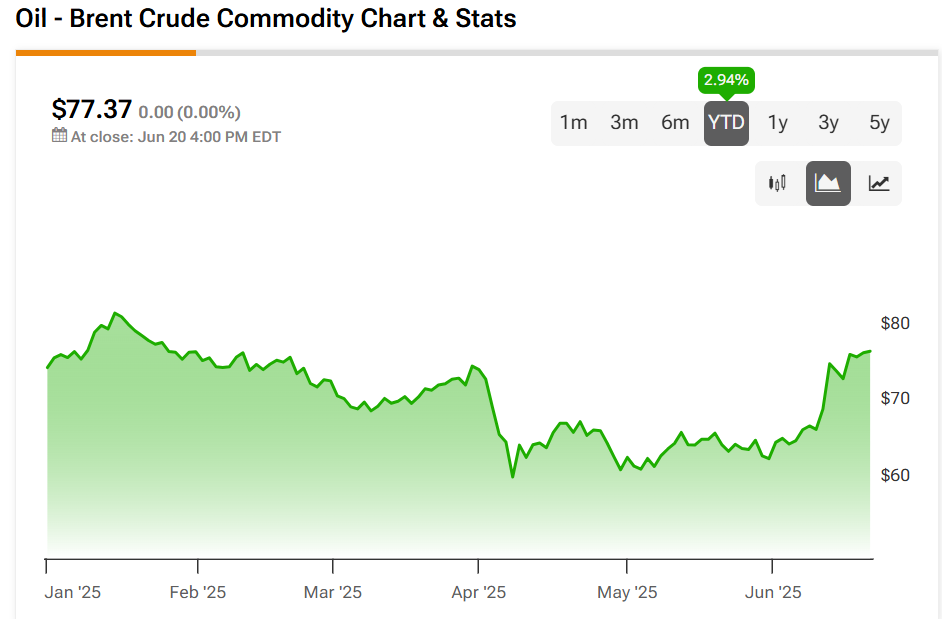

Oil prices are expected to spike when markets reopen. Brent crude is already up 18% since June 10, closing at $77.37 per barrel on Friday. Analysts at Oxford Economics warn that if Iranian oil production is disrupted or the Strait of Hormuz is closed, crude could surge to $130 per barrel. That would push U.S. inflation toward 6% by year-end, sharply reducing the chances of Federal Reserve rate cuts in 2025.

Which Stocks Are Set to Benefit

Higher oil costs may boost energy stocks like ExxonMobil (XOM), Chevron (CVX), and Schlumberger (SLB), but could weigh on consumer-facing sectors. Airlines such as Delta Airlines (DAL) and United Airlines (UAL) may feel margin pressure, while retailers like Target (TGT) and Walmart (WMT) could see demand soften as fuel prices cut into household budgets.

Safe-haven demand is likely to lift the U.S. dollar and Gold (XAUUSD). The dollar has been under pressure for most of the year, but geopolitical tension tends to drive inflows into U.S. assets. Treasury yields may fall if investors rush into bonds, while gold prices could benefit from risk aversion.

Equities typically decline following major military escalations but often rebound in the months that follow. According to Wedbush Securities, the S&P 500 (SPY) has averaged a 2.3% gain two months after the start of previous Middle East conflicts, despite initial losses.

Defense contractors may be another area of interest. Traditional defense stocks, such as Lockheed Martin (LMT) and RTX Corporation (RTX), could attract attention if military engagement continues or expands, but Palantir (PLTR) might also see further contracts being struck.

No One Likes Uncertainty

The bigger question is how long the uncertainty lasts. A quick resolution could limit damage to markets and ease pressure on inflation. But a prolonged standoff or disruption to oil flows would complicate the Fed’s path and keep volatility elevated.

For now, investors should closely monitor key indicators, including oil prices, bond yields, gold, and the U.S. dollar. These will signal whether risk sentiment is stabilizing or deteriorating. Diversification into energy and defense may provide a cushion, while keeping some exposure to gold and cash-like assets could help manage volatility.

Market reactions to geopolitical shocks often evolve quickly. The key is staying informed and being ready to adjust.

We used TipRanks’ Comparison Tool to bring together all the energy, defense, and retail stocks mentioned above, giving you a broader view of each company and how it stacks up within its industry.