Cerebras Systems, an artificial intelligence (AI) chipmaker that competes head-to-head with Nvidia (NVDA), has filed to hold an initial public offering (IPO) in the U.S.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In an IPO prospectus filed with the U.S. Securities and Exchange Commission (SEC), Cerebras said that it plans to trade on the Nasdaq exchange under the ticker symbol “CBRS.” The timing and size of the IPO have yet to be finalized. The company was last valued at $4 billion during a 2021 funding round.

Cerebras Systems launched in 2016 and its microchips and processors are made by Taiwan Semiconductor Manufacturing Co. (TSM). Cerebras competes directly with Nvidia, whose microchips are the industry standard for running AI applications. The company also lists Advanced Micro Devices (AMD), Microsoft (MSFT), and Alphabet (GOOGL) as competitors.

Cerebras Systems Remains Unprofitable

In addition to selling microchips and processors for AI models, Cerebras Systems also offers cloud-based services to clients worldwide. The company’s founder and CEO Andrew Feldman has a track record of success, having sold a server start-up called SeaMicro to AMD in 2012 for $355 million.

However, Cerebras Systems remains unprofitable. The IPO prospectus shows that the company had a net loss of $66.6 million in the first six months of this year on $136.4 million in revenues. During the first six months of 2023, the company reported a net loss of $77.8 million and $8.7 million in revenue. The company is growing at a fast pace, with its sales rising nearly 1,500% year-over-year.

Cerebras Systems is likely to be one of the biggest technology IPOs in coming months. Earlier in 2024, social media platform Reddit (RDDT) and semiconductor company Astera Labs (ALAB) each held successful IPOs in New York. Reddit’s stock ended its first day of trading in New York up 48%, while Astera Labs stock jumped 77% in its market debut.

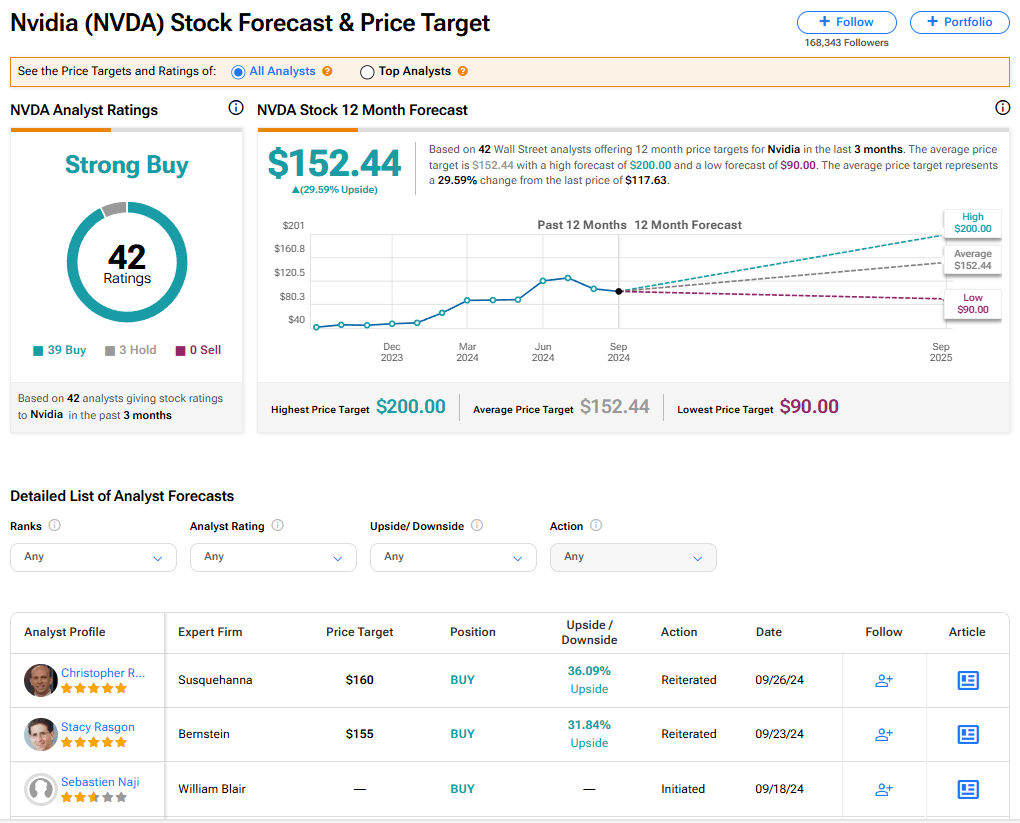

Is NVDA Stock a Buy?

Nvidia stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 39 Buy and three Hold ratings issued in the last three months. There are no Sell ratings on the stock currently. The average NVDA price target of $152.44 implies 29.59% upside from current levels.