IonQ (IONQ) stock rose about 4% Tuesday morning after the company disclosed a major achievement in quantum networking. In partnership with the Air Force Research Lab (AFRL), IonQ successfully converted quantum signals to telecom wavelengths, a key step toward building a Quantum Internet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Building the Quantum Internet

This breakthrough means quantum information can travel long distances using existing telecom infrastructure.

“We are the first quantum company to demonstrate the ability to convert visible signals to telecom wavelengths,” said Niccolo de Masi, Chairman and CEO of IonQ. “We will soon connect two quantum computers over standard wavelengths, opening the floodgates for broadly networked quantum devices using commercial fiber infrastructure.”

Importantly, IonQ’s end goal is to create a secure, distributed Quantum Internet, where quantum devices communicate over long distances. The technology could be a game-changer for telecom and cloud providers preparing for next-gen infrastructure.

IONQ’s Other Recent Milestones

Ahead of this milestone, IonQ delivered its first trapped-ion quantum computer with an integrated photonic interface to AFRL’s facility in Rome, New York. Also, on September 10, it launched IonQ Federal, a new division focused on providing quantum technologies to U.S. government agencies and allied nations.

Importantly, the company’s current quantum computer systems include IonQ Forte and IonQ Forte Enterprise. Looking ahead, IONQ has a goal of building quantum computers with 2 million qubits by 2030.

Lastly, IonQ’s global footprint continues to grow, with operations across the U.S. and Switzerland.

Is IonQ a Good Buy?

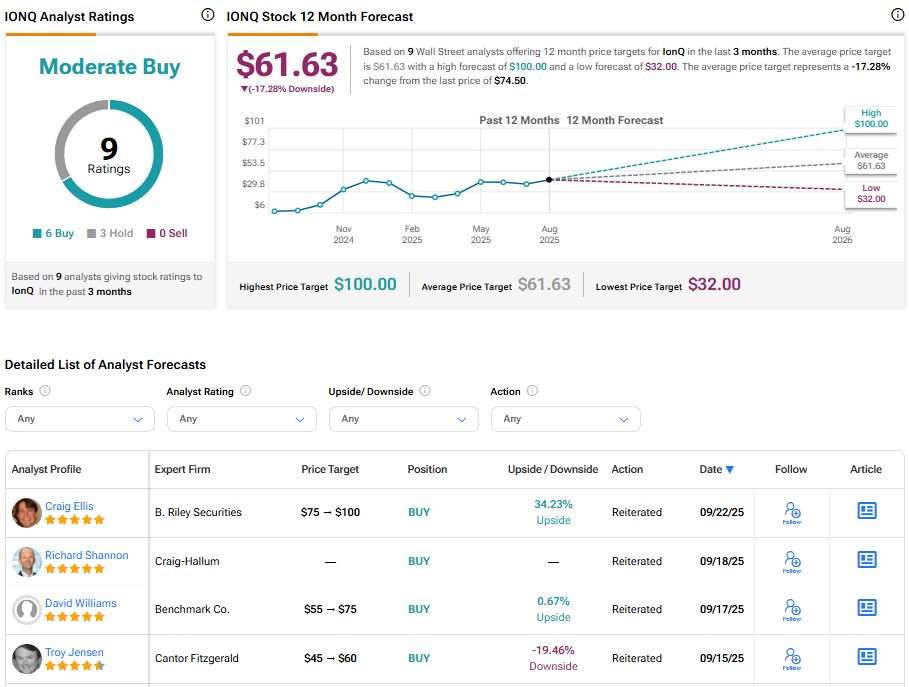

Turning to Wall Street, IONQ has a Moderate Buy consensus rating based on six Buys and three Holds assigned in the last three months. At $61.63, the average IonQ stock price target implies 17.28% downside risk.