IONQ Stock Jumps 17% as Japanese Brokerage Firm Invests Millions

Quantum computing company IonQ’s (IONQ) stock jumped almost 17% on Wednesday after a Japanese brokerage firm, Rakuten Securities, acquired $3.7 million worth of common stock. The investment reflects strong confidence in IonQ, with many analysts seeing the company as a potential frontrunner in the quantum computing industry. Despite this rally, IONQ stock remains down 48% year-to-date, weighed down by the broader sell-off in U.S. tech stocks due to recent tariff concerns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IonQ develops and provides advanced quantum hardware and cloud-based computing services.

More Details on the Investment

Rakuten Securities, part of Japan-based technology conglomerate Rakuten Group (JP:4755), bought 90,000 shares for $3.7 million, making the quantum computing stock its ninth-largest holding. Although quantum technology is still in its early stages with uncertain widespread applications, the substantial investment from a major brokerage firm highlights growing confidence in IonQ’s potential.

Additionally, IonQ’s stock surged after the company announced that its quantum networking patent portfolio had expanded to nearly 400 granted or pending patents. Its recent acquisition of ID Quantique contributed nearly 300 new patents, bolstering its technological capabilities.

IonQ Director William Scannell Buys $2.03M in Shares

In another development, William F. Scannell, a director at IonQ, recently purchased shares worth $2.03 million. According to an SEC filing, Scannell acquired 93,066 shares of IonQ common stock at an average price of $21.8072 per share on March 12.Following this purchase, Scannell’s total direct stake in IonQ has increased to 135,047 shares.

Having said that, Peter Hume Chapman, IonQ’s Executive Chair, sold $37.4 million worth of common stock earlier this week. According to TipRanks’ data, corporate insiders have collectively executed informative sell transactions totaling $37.4 million over the past three months. Meanwhile, TipRanks’ Insider Trading Activity Tool shows that insider confidence in IONQ stock is currently negative.

Is IonQ a Good Stock to Buy?

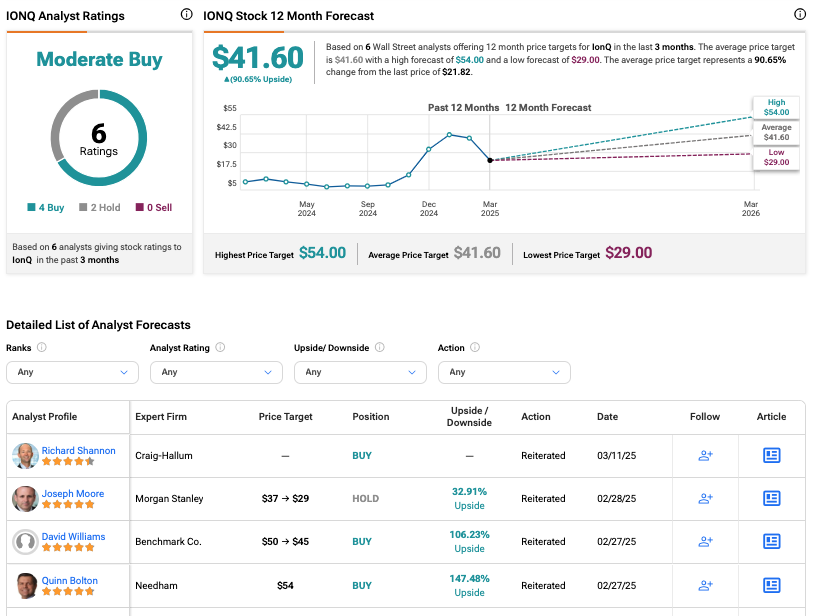

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IONQ stock based on four Buys, two Holds, and zero Sells assigned in the last three months. The average IONQ price target of $41.60 implies a 90.65% upside potential.