Investors searching for growth opportunities in the small-cap space could consider the Russell 2000 index. Among its many companies, two stocks, IonQ (IONQ) and Rigetti Computing (RGTI), have recently caught the attention of investors after their Q1 earnings. Notably, the Russell 2000 index tracks the performance of 2,000 small-cap stocks in the U.S.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Let’s dive into the details on these two stocks.

Rigetti Computing

Rigetti Computing focuses on developing hybrid quantum-classical systems to solve complex computational challenges across multiple industries. RGTI stock has declined by almost 21% year-to-date.

The company surprised with Q1 FY2025 earnings of $0.13 per share, beating expectations of a $0.05 loss, thanks to $62.1 million in non-cash gains. The company is advancing in quantum tech with new U.S. and UK government-backed projects, and CEO Dr. Subodh Kulkarni highlighted efforts to scale systems through modular, flexible designs.

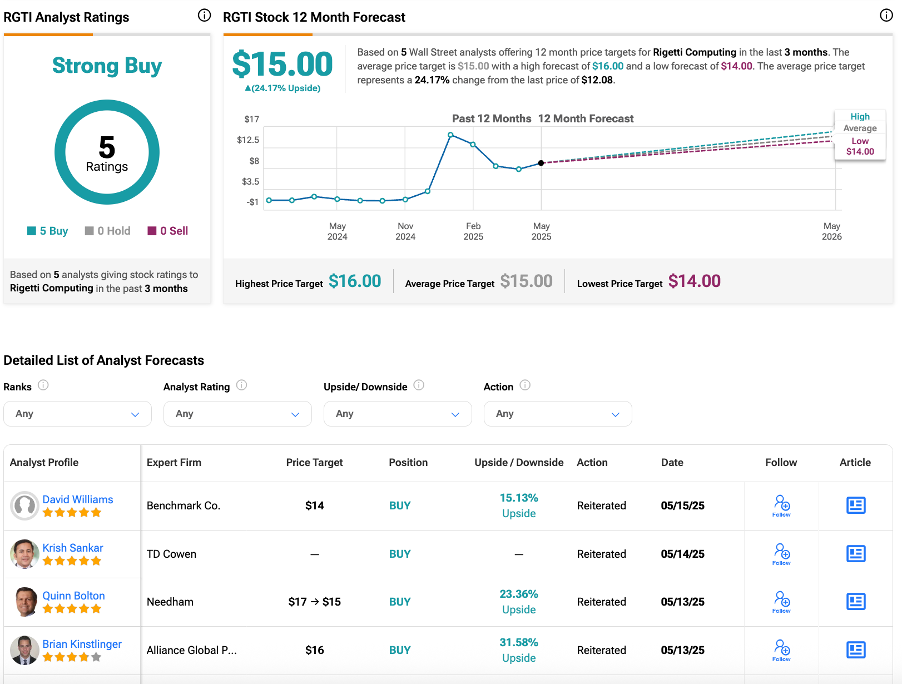

Yesterday, Benchmark’s four-star analyst David William reaffirmed his Buy rating on RGTI stock, predicting a 15% growth rate. According to TipRanks, Wall Street analysts have rated the stock as a Strong Buy. Interestingly, all five analysts who rated the stock gave it a Buy. Overall, Rigetti’s stock forecast of $15.50 implies an upside of about 24%.

IonQ

IonQ develops and provides advanced quantum hardware and cloud-based computing services. Year-to-date, IONQ stock has declined by over 18%.

The company posted a smaller-than-expected loss of $0.14 per share in Q1 as compared to the estimated $0.26. It also posted slightly higher revenue of $7.57 million. Notably, IonQ ended the quarter with $697.1 million in cash.

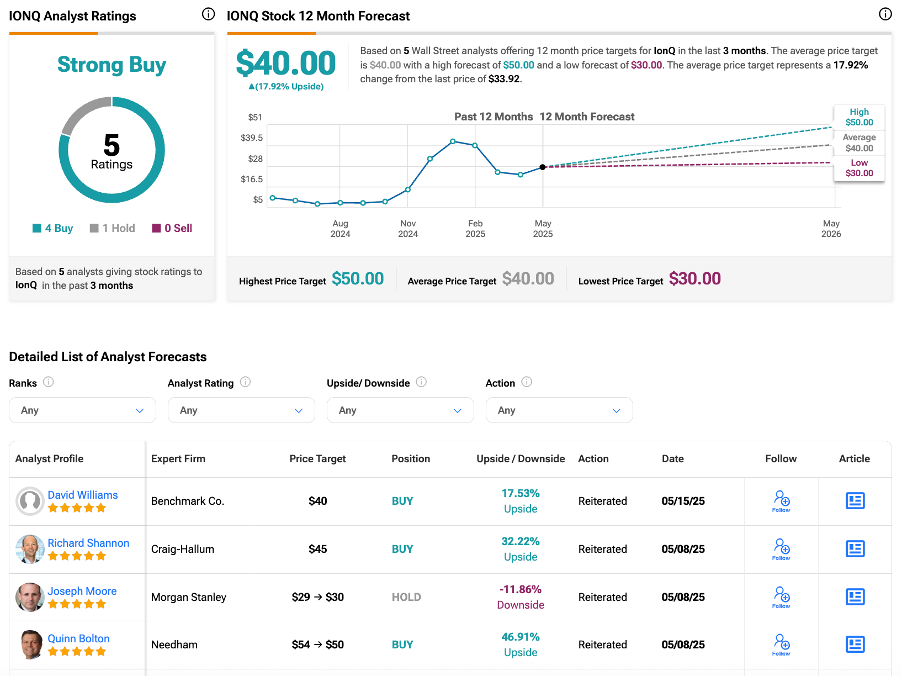

Yesterday, William also maintained his Buy rating on IonQ, forecasting a 17% upside. Overall, four of five analysts covering the stock rate it a Buy, with an IonQ stock price target of $40, implying a 18% gain from current levels.