Quantum computing firm IonQ (IONQ) has announced pricing of a $1 billion equity offering. This significant capital injection comes from Heights Capital Management, Inc., a private equity firm.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Importantly, the funding includes IonQ’s common shares priced at $55.49, a 25% premium over IonQ’s July 3 closing price, and seven-year warrants exercisable at $99.88 per share.

This deal boosts IonQ’s cash reserves to $1.68 billion. With this funding, the company is expected to scale its quantum systems, expand global partnerships, and push toward its goal of building 2 million qubit machines by 2030.

CEO Niccolo de Masi noted the strategic importance of this funding. He said the investment is a strong validation of IonQ’s “technical momentum, recent acquisitions, IP, and talent density.”

Previous Equity Round Fueled Momentum

Earlier this year, IonQ raised $360 million through an at-the-market (ATM) equity offering, selling over 16 million shares before closing the program in March. The new capital helped fund the development of its Forte and Forte Enterprise platforms, which are now delivering performance gains for clients like Amazon’s (AMZN) AWS, AstraZeneca (AZN), and Nvidia (NVDA).

With quantum computing still in its early stage, IonQ’s fresh capital and growing business momentum position it well to make the technology commercially viable.

Is IonQ a Good Stock to Buy?

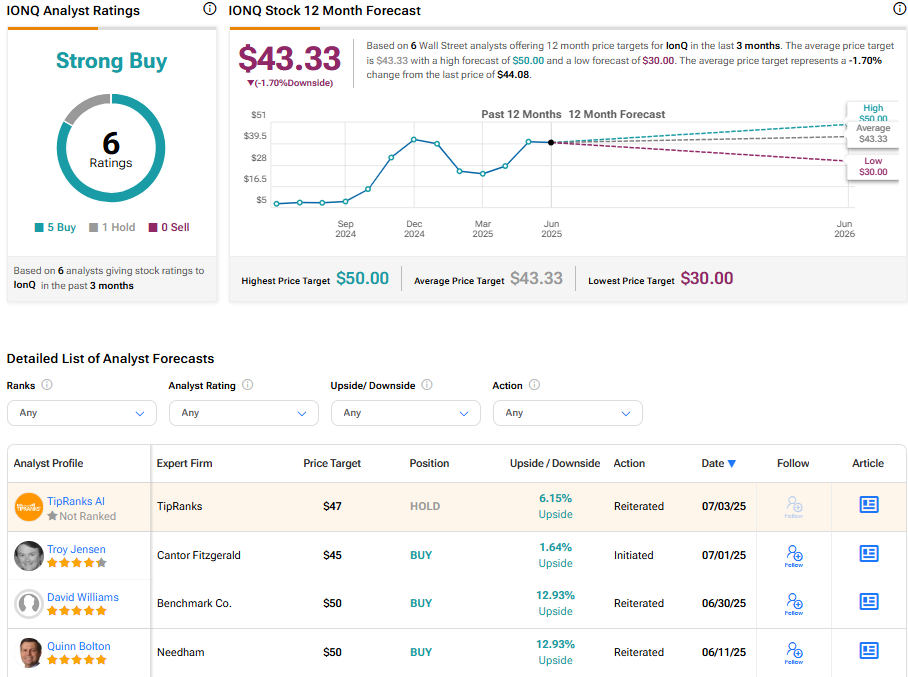

Turning to Wall Street, IONQ stock has a Strong Buy consensus rating based on five Buys and one Hold assigned in the last three months. At $43.33, the average IonQ stock price target implies a 2.39% downside potential.