If you would like an example of how fickle Wall Street can be sometimes, look no further than what happened to quantum computing stocks earlier this week.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Names operating in this up-and-coming segment have gone on some turbocharged runs in recent times, with investors becoming very excited about the potential of this groundbreaking technology. Quantum computers promise a level of speed and computational power that traditional computers can scarcely imagine.

But “potential” might be the key word here, as these companies could still be a while away from making any real-world impact – something Nvidia CEO Jensen Huang was quick to highlight at the CES tech event. In fact, Huang said it would probably be around 20 years before quantum computing was ready to be properly used, and that was the signal for a massive sell-off across the quantum computing space.

However, Craig-Hallum’s Richard Shannon, an analyst ranked in the top 1% of Wall Street stock pros, believes Huang’s statement is quite an exaggeration – albeit not surprising, considering the chip giant could face potential threats from this segment.

Shannon thinks quantum computing could be “disruptive to parts of the classical compute business, of which Nvidia is a chief beneficiary.” Moreover, helping to prop up what might become a vital industry, Shannon points out that over the next few years there will be “considerable government-related revenues” coming in. “If investors are worried about minimal revenues that will require dilution, they are missing a key part of the equation,” the analyst went on to say.

What investors should be doing, according to Shannon, is paying attention to two of the leading names in the Quantum computing space – IonQ (NYSE:IONQ) and Rigetti (NASDAQ:RGTI).

The 5-star analyst isn’t alone in his optimism. According to TipRanks data, both stocks boast Strong Buy ratings from the analyst consensus. Let’s dive deeper to see why Shannon and the broader Street are getting behind these names.

IonQ

The first quantum computing stalwart we’ll look at is IonQ, a College Park, Maryland-based company specializing in creating general-purpose trapped ion quantum computers – designed to handle a wide variety of computational tasks. IonQ also develops software to generate, optimize, and run quantum circuits.

Founded in 2015 by Duke University professors Christopher Monroe and Jungsang Kim, IonQ builds on 25 years of academic research in quantum information science, showcasing its founders’ extensive expertise in the field.

For those unfamiliar, trapped ion technology uses individual ions (charged atoms) as quantum bits, or qubits – the fundamental units of quantum computation. These ions are confined in a vacuum chamber using electromagnetic fields and manipulated with lasers or other precise controls to manage and measure their quantum states.

IonQ has also built a robust intellectual property portfolio, holding more than 600 issued and pending U.S. and international patents. These cover a range of innovations aimed at enhancing the performance, efficiency, and scalability of quantum systems.

Despite its groundbreaking advancements, IonQ remains in the early stages of commercial development, as reflected in its modest revenue figures. In Q3, the company reported $12.4 million in revenue – a relatively small sum but a notable 103.3% year-over-year increase, surpassing estimates by $1.82 million.

Considering IonQ’s prospects, top analyst Richard Shannon believes investors should get on board sooner rather than later.

“Most investors view IONQ (and quantum computing broadly) as a late stage science/engineering project, but not one that will result in realworld revenues any time soon,” Shannon explained. “IONQ has made it a mission to find early applications to drive fast solutions, and announced two customers – AstraZeneca and Ansys (simulation software) – that it believes will get there first… While we aren’t going to get ahead of ourselves, in terms of baking in real-world sales at this time, investors should recognize that the opportunity is large, and in combination with a strong balance sheet (we see balance sheet risk as eliminated for at least 2-3 years), IONQ is the safest way to quantum computing.”

These comments underpin Shannon’s Buy rating for IONQ, alongside a $45 price target, implying 12-month returns of 37% from current levels. (To view Shannon’s track record, click here)

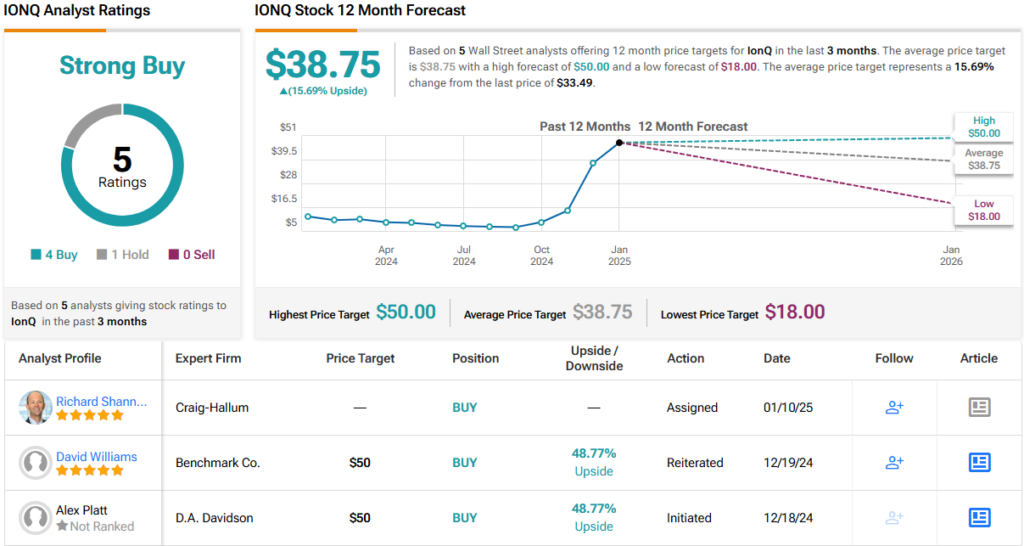

Other analysts share Shannon’s optimistic outlook. Of the 4 others covering IonQ, 3 rate it a Buy, while one assigns a Hold, resulting in a Strong Buy consensus. With an average price target of $38.75, the stock is projected to offer a ~16% upside over the next 12 months. (See IONQ stock forecast)

Rigetti Computing

The next quantum name we’ll examine is Rigetti Computing, whose stock experienced a monster run-up until Huang burst the quantum balloon. Over less than two months at the end of last year, Rigetti shares skyrocketed by nearly 1,300%.

The company was founded in 2013 by physicist Chad Rigetti, a well-known player in the quantum computing industry. Headquartered in Berkeley, California, Rigetti specializes in building quantum computers powered by superconducting quantum processors. It has a full-stack approach, which includes the design and fabrication of quantum chips, integration with control architectures, and the development of software tools that enable programmers to create quantum algorithms. Through its QCS (Quantum Cloud Services) platform, Rigetti provides access to quantum computing capabilities that can be integrated into public, private, or hybrid cloud environments.

Moreover, Rigetti has established significant collaborations with various government agencies to advance quantum computing. In September 2023, it secured a five-year Indefinite Delivery Indefinite Quantity (IDIQ) contract with the Air Force Research Lab Information Directorate. Additionally, in October 2023, Rigetti joined the DARPA (Defense Advanced Research Projects Agency) to participate in the IMPAQT (Imagining Practical Applications for a Quantum Tomorrow) program. This initiative focuses on advancing quantum algorithms for solving combinatorial optimization problems, with the goal being to boost the practical applications of quantum computing in complex problem-solving scenarios.

For Craig-Hallum’s Shannon, Rigetti’s government connections could prove important in advancing its case.

“We believe RGTI’s longstanding experience in chiplet design, foundry feedback loop with the government, and potentially exclusive access to unique developments from government labs give RGTI an underrecognized ability to scale to quantum advantage as early as C28 and remain ahead of competitors thereafter,” the analyst explained. “Government priorities for QC have and will drive significant near-term spending that drives 1) non-dilutive capital for RGTI and 2) creates IP transfer potential to accelerate RGTI’s roadmap. RGTI’s strong relationships with multiple USG groups, along with pending legislation to provide more spending, are accelerators to RGTI and its QC development.”

Quantifying that stance, Shannon rates RGTI shares a Buy, while his $12 price target implies the stock will climb ~18% higher over the one-year timeframe.

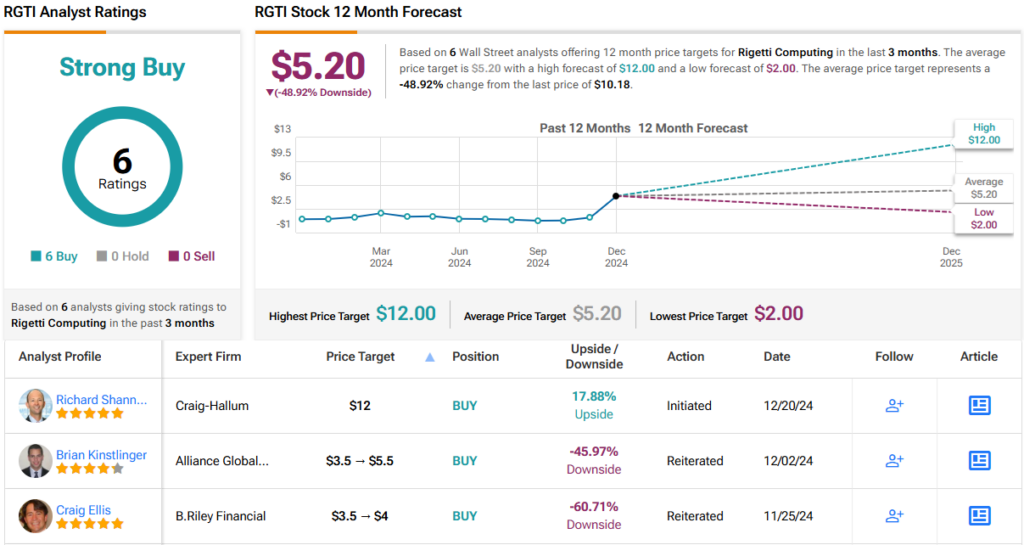

Wall Street’s current view on this stock appears somewhat confusing. Rigetti gets a Strong Buy consensus rating based on 6 unanimous Buys. However, the $5.20 average price target factors in a 12-month decline of ~49%. It will be interesting to see whether analysts increase their price targets or downgrade their ratings shortly. (See RGTI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.