IonQ (IONQ) is at the forefront of quantum computing, leveraging its unique trapped-ion technology to revolutionize various industries. Unlike traditional computers that use bits, IonQ’s quantum computers use qubits, which can exist in multiple states simultaneously. This allows them to solve complex problems much faster than classical computers. IonQ’s technology is particularly suited for cybersecurity, finance, and pharmaceutical industries, where it can optimize algorithms, enhance encryption, and accelerate drug discovery.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Impossible Expectations Creates Volatility

Year-to-date, IonQ’s stock has experienced significant volatility. Despite an impressive 164.6% rally earlier in the year, the stock faced a sharp decline following remarks from Nvidia’s (NVDA) CEO, Jensen Huang. During an analyst day, Huang expressed optimism about quantum computing’s future but warned that practical applications might be 15 to 30 years away. This cautious outlook led to a notable drop in IonQ’s stock price, as with other quantum stocks, reflecting investor concerns about the extended timeline for quantum advancements. After Google (GOOGL) revealed its ‘Willow’ grand chip, many people and investors were under the illusion that quantum technology was just around the corner. In historical terms, it’s definitely just around the corner. But it’s still a few years from today.

If we’re talking about timelines, IonQ has set ambitious targets for 2030. The company aims to achieve profitability by then, with projected sales nearing $1 billion. From an investor’s perspective, IonQ’s long-term potential remains promising. The company’s high market cap, which stands at approximately $8.55 billion, and substantial funding provide it with the financial muscle to continue investing in research and development. This strong financial position is crucial for navigating the challenges and uncertainties in the quantum computing sector.

Nevertheless, IonQ is considered one of the most promising quantum companies around and, therefore, is subjected to significant volatility stemming from its investors’ high expectations, meaning they want to see tangible progress as soon as possible, no matter how unrealistic. However, recently, Forbes recognized IonQ as one of “America’s Most Successful Mid-Cap Companies” for 2025. This recognition highlights IonQ’s commercial growth and innovation, further boosting investor confidence.

Is IONQ a Good Stock to Buy?

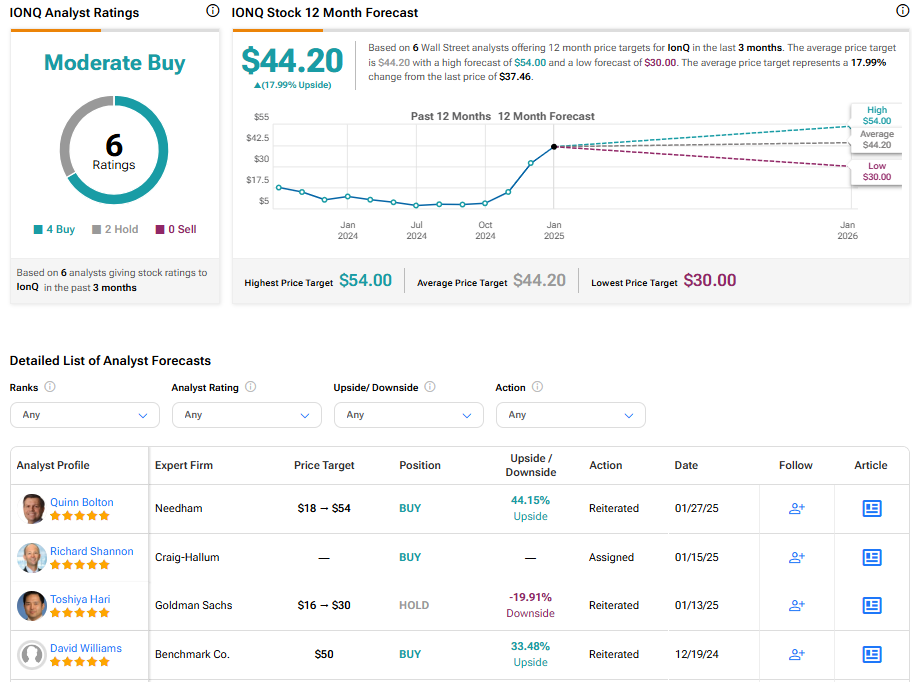

Turning to Wall Street, IonQ is considered a Moderate Buy. The average price target for IONQ stock is $44.20, suggesting a 17.99% upside potential.

Last Word

IonQ has had ups and downs in its stock value but remains a leader in innovation. Its trapped-ion technology is set to change fields such as cybersecurity, finance, and pharmaceuticals. Although there is some market fluctuation due to investor expectations, the company aims for big goals by 2030 and is financially strong, which bodes well for its future. Forbes has also highlighted IonQ as one of “America’s Most Successful Mid-Cap Companies” for 2025, maintaining confidence and excitement as it works to change computing.