Biopharmaceutical company Biogen Inc. (Nasdaq: BIIB) has announced its second quarter 2022 results. While earnings and revenues surpassed estimates, the company witnessed a year-over-year decline in these metrics. Meanwhile, Biogen has upwardly revised its financial guidance for the full-year 2022.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite decent results, shares of Biogen declined 5.8% on Wednesday, largely due to the disappointing performance of its three major drugs — TECFIDERA, TYSABRI, and SPINRAZA.

Biogen’s Q2 Results in Detail

Diluted earnings came in at $5.25 per share in the reported quarter, down 7.6% year-over-year. However, the metric beat the Street estimates of $4.06 per share.

Biogen reported revenue of $2.59 billion, down 7% at actual currency and 5% on a constant currency (CC) basis from the year-ago quarter. Meanwhile, the revenue figure outpaced analysts’ expectations of $2.48 billion.

The biopharmaceutical company’s Multiple Sclerosis (MS) revenue was $1.72 billion in the second quarter, down 4% (3% at CC) year-over-year. The figure included royalties on sales of OCREVUS.

Revenue of TECFIDERA, which is used in the treatment of Multiple Sclerosis, declined to $397.9 million in the reported quarter from $487.6 million in the year-ago period. TYSABRI’s revenue declined to $516.2 million in the second quarter from $524.2 million in the year-ago quarter.

Revenue from SPINRAZA, a spinal muscular atrophy drug, came in at $431 million, down 14% year-over-year. Biosimilars’ revenue came in at $194 million, down 4% year-over-year at actual currency but up 3% on a constant currency basis.

Profits from RITUXAN/GAZYVA that were attributable to Biogen also declined 21% over the prior year to $144 million.

Biogen Updates Outlook

Biogen has revised its full-year 2022 financial guidance. The company now expects total revenues in the range of $9.9 billion to $10.1 billion from $9.7 to $10 billion stated previously. Further, the company anticipates non-GAAP diluted EPS for 2022 in the range of $15.25 to $16.75 from $14.25 to $16 anticipated earlier.

According to the company, better-than-expected topline performance and consistent cost management have led to the upward revision in the financial guidance.

The biopharmaceutical company repurchased around 2.4 million shares of its common stock for a total value of $500 million in the second quarter of 2022.

Street Is Positive on Biogen

Overall, the Street is optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys and eight Holds. Biogen’s average price target of $245.89 signals that the stock may surge nearly 18.51% from current levels. Shares of the company have lost 15% so far this year.

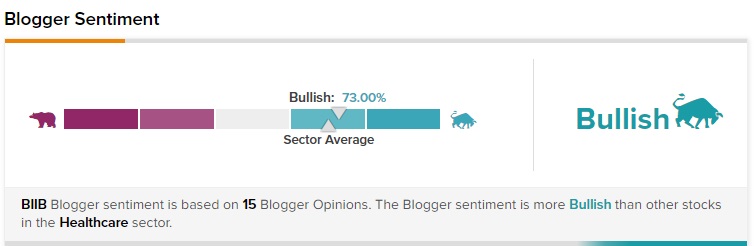

According to TipRanks, financial bloggers are 73% Bullish on BIIB, compared with the sector average of 70%.

TipRanks data shows that hedge funds are Very Positive about the stock, as they bought 760,900 shares of BIIB in the last quarter.

Is BIIB Stock Worth Your Time & Money?

The biopharmaceutical company continues to see weakness in the performance of its major drugs — TECFIDERA, TYSABRI, and SPINRAZA — due to competition from generic drugs.

However, Biogen has seen significant progress regarding its new potential treatments for patients suffering from Alzheimer’s disease and depression. In this regard, the U.S. FDA accepted the Biologics License Application and approved priority review for lecanemab in July. Also, the company’s upbeat guidance for 2022 is a positive for the stock.

Read full Disclosure.