Shares of medical equipment company Intuitive Surgical (NASDAQ:ISRG) fell in after-hours trading after the company reported earnings for its third quarter quarter of Fiscal Year 2023. Earnings per share came in at $1.46, which beat analysts’ consensus estimate of $1.42 per share. Sales increased by 11.5% year-over-year, with revenue hitting $1.74 billion. This missed analysts’ expectations by $30 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company pointed to a 19% surge in its Worldwide da Vinci procedures as one of the revenue drivers. From the third quarter of 2019 to the third quarter of 2023, the compound annual growth rate was approximately 17%.

Still on da Vinci, the company said it placed an additional 312 surgical systems, a bump over the 305 in Q3 2022. Therefore, the number of installed da Vinci surgical systems now stands at 8,285 as of September 30, 2023, up 13% from the 7,364 at the end of the third quarter of 2022.

Is Intuitive Surgical a Good Stock?

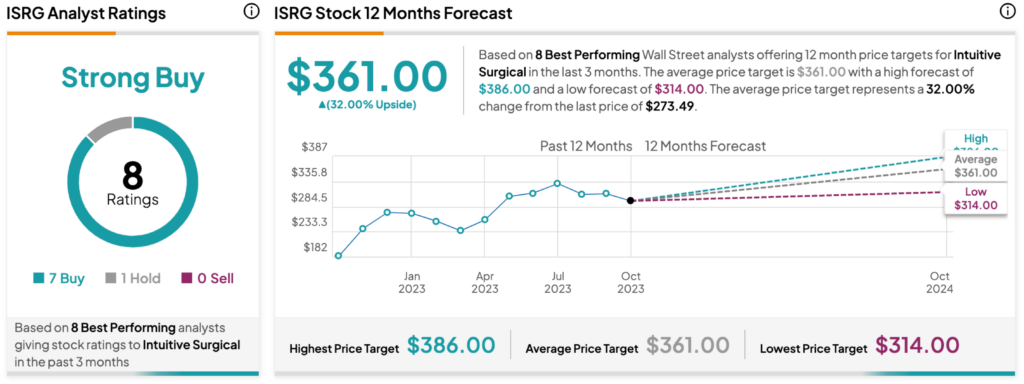

Turning to Wall Street, analysts have a Strong Buy consensus rating on ISRG stock based on seven Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average ISRG price target of $361 per share implies a 32% upside potential.