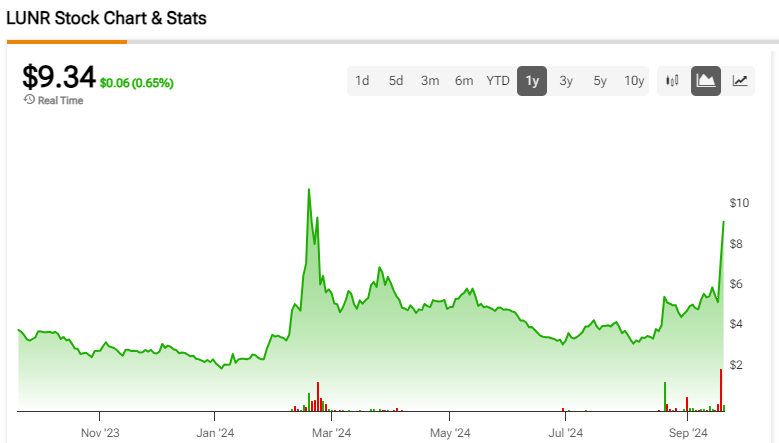

Intuitive Machines, Inc. (LUNR), a fast-growing space systems and infrastructure developer headquartered in Houston, Texas, is making steady progress toward space domination by securing high-value contracts with NASA, the Department of Defense, and other international space agencies. Although Intuitive Machines still has a lot to prove, there are some early signs of competitive advantages. I am bullish on the prospects for Intuitive Machines stock as I believe the company is well-positioned to benefit from the growth of the private space exploration sector. The stock has been volatile, having seen a few price spikes in the past year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent Contract Wins Suggest Technological Superiority

Intuitive Machines has secured several high-value contracts in the past 12 months, which suggests the company’s lunar landing technology is winning the trust of space agencies, supporting my bullish view. The latest contract win was announced on Sep. 18, a $4.82 billion contract with NASA as part of the Artemis program. Intuitive will be an infrastructure solutions provider to support the deployment of a constellation of lunar relay satellites to enhance the communication capabilities of NASA. The company will receive an initial award of $150 million according to contract terms.

In addition to the recent NASA contract, Intuitive has secured many other contracts in the recent past, including a $9.5 million contract with the Department of Defense, a $719 million contract with NASA as part of OMES III, and a $16.8 million contract with an unnamed international space agency.

These contract wins have already started yielding promising financial results for the company. In the first half of 2024, Intuitive reported revenue of $114.5 million, higher than the full-year revenue of $79.5 million reported last year. So far this year, Intuitive has added $70 million in backlog as well, ending the second quarter with a contracted backlog of $213 million.

Favorable Industry Conditions Paint a Promising Picture

Favorable macroeconomic conditions are at the center of my bullish stance for Intuitive Machines. The U.S. and China are involved in a new space race to conquer the moon, prompting both governments to spend aggressively on space exploration. China is planning to send astronauts to the moon by 2030 and even build a base on the surface of the moon. China, last June, became the first nation to bring a rock sample from the far side of the moon, which highlights the progress the country has made in the recent past. Amid this intensifying competition from China, NASA has shown an increasing willingness to double down on the lunar economy. This should boost the demand for Intuitive Machines’ lunar landing services.

The growing commercial interest in the lunar economy is also a favorable market shift. According to PWC’s lunar market assessment report published in late 2021, the total value of the lunar transportation market between 2020 and 2040 is estimated to reach $79 billion, which highlights the massive growth opportunity for lunar transport solutions providers such as Intuitive Machines.

Finally, the growing tendency for government agencies to collaborate with private companies should also boost the growth of the space exploration sector as these partnerships will lure substantial capital into this market, accelerating the pace at which the industry moves forward.

Recent Mission Success Paves The Way For Stellar Growth

One of the main factors behind my bullish stance for Intuitive Machines is the company’s recent mission success, which paves the way to attract high-value clients and gain an edge over its competitors. Last February, the IM-1 mission was successfully completed with Intuitive’s Odysseus lunar lander successfully landing on the moon, marking the first American lunar landing since Apollo 17 more than 50 years ago. According to NASA, the lunar lander transmitted 350 megabytes of data back to Earth, meeting expectations. This success established Intuitive Machines as the first private company to land on the moon.

This successful mission completion helped Intuitive Machines fully book its IM-2 mission with several commercial and rideshare payloads. The second mission, which is expected to be completed in January 2025, marks an important milestone for the company as its lunar lander will attempt the first in-situ resource utilization demonstration on the lunar surface.

Intuitive Machines’ early success is likely to help the company attract high-value government and commercial customers in the coming months, leading to strong backlog growth.

Technological Investments Will Open New Doors to Grow

Intuitive Machines’ focus on diversifying its revenue through strategic technological investments is also an encouraging sign that has improved my sentiment toward the company. Although Intuitive is currently identified as a lunar delivery services provider that is focused on the delivery of satellites, scientific instruments, and cargo to space destinations including the moon, the company is strategically expanding into two other business areas; data transmission services and autonomous space operations. During the second quarter, Intuitive Machines made progress on both these fronts.

As part of the data transmission business, the company downloaded 1.7GB of total space data including 550MB of lunar surface data gathered and sent across to Earth. Intuitive Machines’ data transmission capabilities are likely to attract new customers as they reduce the friction of using different service providers for transportation and data collection.

The autonomous operations business is focused on developing space assets that perform tasks and make decisions without human intervention. Autonomous functions developed by Intuitive Machines include navigation, maintenance, and even data collection. In the second quarter, the company completed 167 autonomous operation hours, suggesting that Intuitive will soon be in a position to monetize these technologies.

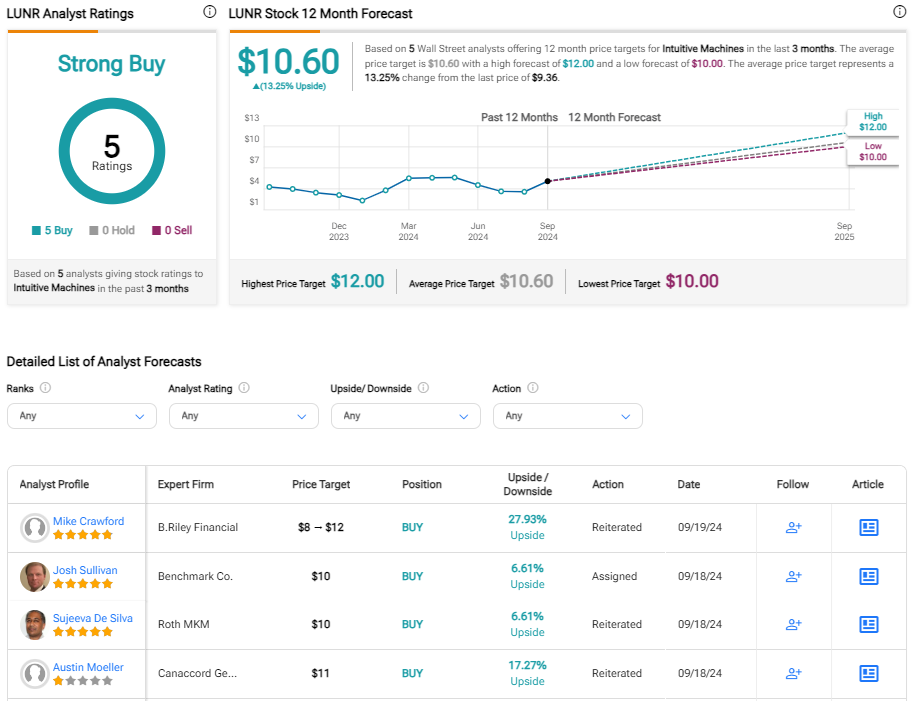

Is Intuitive Machines a Buy, According to Wall Street Analysts?

Soon after Intuitive Machines announced the $4.82 billion NASA contract earlier this week, Canaccord Genuity analysts assigned the company a price target of $11 given the significant positive impact it will have on revenue growth and margin expansion. The recent surge in the stock price, however, has limited the upside potential. Based on the ratings of 5 Wall Street analysts, the average Intuitive Machines price target is $10.60, which implies upside of 16% from the current market price.

In the long run, I believe Intuitive Machines’ financial performance will be stellar and lead to much higher stock prices, especially if the company establishes itself as a market leader.

Takeaway

Intuitive Machines recently secured a multi-billion-dollar NASA contract, highlighting the company’s progress toward winning the trust of government space agencies for high-value contracts. Intuitive Machines is well positioned to benefit from favorable industry conditions and the company is aggressively investing in new technologies to drive revenue growth. Even on the back of recent gains, Intuitive Machines stock seems an attractive bet on the future of the space industry.