Shares of software company Intuit (INTU) are sinking in after-hours trading after reporting solid first-quarter results but disappointing with its guidance. Earnings per share came in at $2.50, which beat analysts’ consensus estimate of $2.36 per share. In addition, sales increased by 10% year-over-year, with revenue hitting $3.3 billion. This also beat analysts’ expectations of $3.14 billion. These results were driven by its Global Business Solutions Group and Credit Karma.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Global Business Solutions Group saw revenue rise 9% to $2.5 billion due to a 20% increase in Online Ecosystem revenue to $1.9 billion, which was supported by 19% growth in online services and a 21% increase in QuickBooks Online Accounting revenue. In addition, Credit Karma revenue surged 29% to $524 million thanks to growth in personal loans, auto insurance, and credit cards.

Intuit Repurchases $570 Million Worth of Shares

During the first quarter, Intuit repurchased approximately $570 million worth of shares and has $4.3 billion left under its buyback plan. The company frequently buys back its own shares each quarter, as demonstrated in the image below.

Intuit also announced a $1.04 per share dividend. The dividend equates to a 16% year-over-year increase and is the 13th year of dividend growth, according to TipRanks’ data. Nevertheless, both buybacks and dividends are a relatively small drop in the bucket when considering its $180 billion market cap and $679.19 share price at today’s close.

Guidance for FY 2025

Looking forward, management has provided the following guidance for FY 2025:

- Revenue of between $18.16 billion and $18.347 billion versus analysts’ estimates of $18.26 billion

- Adjusted EPS in the range of $19.16 to $19.36 compared to analysts’ estimates of $19.33

As we can see, the company’s outlook is worse than expected when using its midpoint figures, which likely led to the after-hours move in the stock price. Interestingly, this is the same annual guidance that Intuit issued in its last earnings report. Given that analysts had estimates that were higher than the midpoint, it suggests that they were expecting the firm to raise its forecast.

What Is the Fair Value of Intuit?

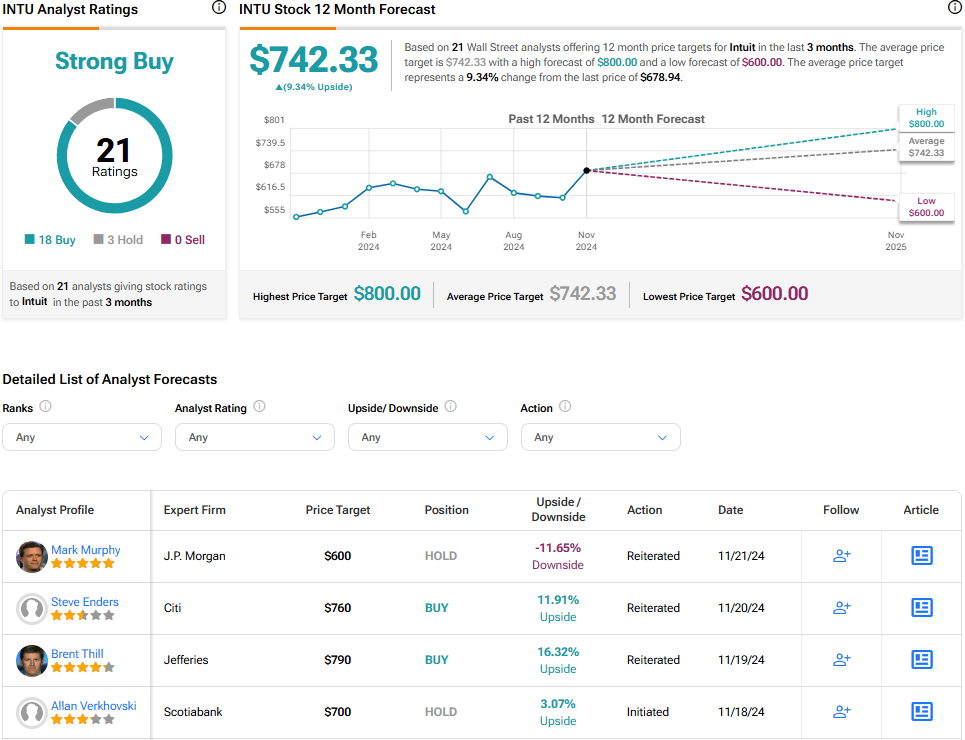

Turning to Wall Street, analysts have a Strong Buy consensus rating on INTU stock based on 18 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 21% rally in its share price over the past year, the average INTU price target of $742.33 per share implies 9.34% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.