Never Miss Key Insights from Earnings Calls Again

Earnings season can be overwhelming, but at TipRanks, we understand the need for clarity and efficiency. That’s why we’re excited to introduce our new Earnings Call Summary – TL;DL (Too Long, Didn’t Listen), designed to distill earnings calls into easy-to-act-upon insights.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is the Earnings Call Summary – TL;DL?

The Earnings Call Summary – TL;DL simplifies each company earnings call into a quick, clear, and concise summary. Whether you’re on the go or just want to cut through the noise, use this feature to find:

1. Earnings Call Sentiment

We summarize the overall tone of the earnings call, which can be positive, negative or neutral, giving you an overall sense of the management’s outlook and company performance.

For example:

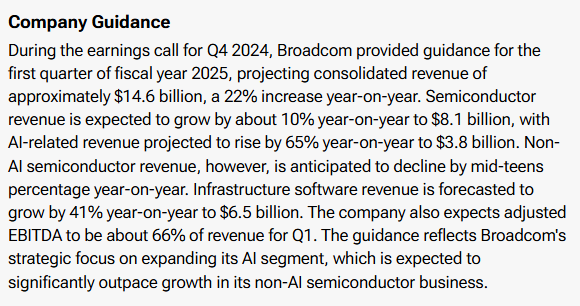

2. Management’s Guidance

Get updates on any forward-looking projections, including revenue, growth targets, and other key metrics shared during the call.

For example:

- “Broadcom provided guidance for Q1 2025 with consolidated revenue expected to grow 22% year-over-year to $14.6 billion.”

3. Highlights and Lowlights

Notable wins and challenges from the earnings call are categorized clearly:

- Highlights showcase revenue growth, strategic achievements, shareholder returns and more.

- Lowlights flag underperforming segments or challenges worth monitoring.

For example:

AI Revenue Surge – “AI-related revenue grew 220% year-on-year, representing 41% of semiconductor revenue.”

Broadband Segment Weakness – “Q4 broadband revenue fell 51% year-on-year to $465 million.”

Negative Earnings Sentiment

Not all earnings calls deliver good news. Below are some examples where negative sentiment was apparent during the most recent earnings call. Investors can find this useful because in most cases, negative earnings call sentiment can lead to a stock price decline.

Example #1: NXP Semiconductors (NASDAQ:NXPI)

Sentiment: Negative

Reasoning: “..these were overshadowed by declines in key segments such as Industrial and IoT, and Automotive, along with a reduced revenue outlook for Q4 due to macroeconomic pressures.”

Stock Price Decline After Earnings Call (Nov 04, 2024): -9.35% (As of Jan 01, 2025)

Example #2: Microchip (NASDAQ:MCHP)

Sentiment: Negative

Reasoning: “The earnings call highlighted Microchip’s strategic innovations and capital returns to shareholders, but these were overshadowed by significant revenue declines, inventory challenges, and external market weaknesses, particularly in Europe. “

Stock Price Decline After Earnings Call (Nov 05, 2024): -23.10% (As of Jan 01, 2025)

Where to Find It?

You’ll find the Earnings Call Summary – TL;DL under the Earnings Tab of most of the stock pages on TipRanks.

Whether you’re a seasoned investor or a beginner looking for actionable insights, the Earnings Call Summary – TL;DL saves you time while helping you stay informed. No more scanning reports or listening to hour-long calls – we do the work for you!

Stay tuned as we continue to bring you tools that make smarter investing simple.