Intel (INTC) stock is unwanted on Wall Street right now. The company is seemingly indefensible and uninvestable. However, that’s exactly why I’m bullish on INTC stock. I invite you to consider the other side of the most obvious trade, as non-obvious investments can be the most successful ones in the long run.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Intel is a microchip designer and, unlike some other chipmakers, the company is establishing a foundry business. This means Intel will eventually differentiate itself by producing chips from start to finish and selling them to other companies.

That’s a massive and ambitious undertaking, to say the least. It will require huge sacrifices, especially if you’re a worker who happens to get laid off from Intel or if you’re an income-focused Intel shareholder. Nevertheless, Intel’s loyal investors should focus on the future and think about what it really means to be a contrarian.

Intel’s (Somewhat) Dreadful Quarterly Results

For one thing, contrarian investing often means buying shares of a huge company when it’s currently not doing very well. This describes Intel perfectly, since the company’s second-quarter 2024 results and forward guidance certainly didn’t live up to the market’s expectations.

Just to prepare you for Intel’s dreadful results, INTC stock tumbled 27% today, the day after Intel released its quarterly report. Were the Q2-2024 results really all that bad, though?

Well, they certainly weren’t good. Intel’s revenue declined 1% year-over-year to $12.8 billion, whereas the analysts’ consensus estimate called for revenue of $12.9 billion. That’s almost an in-line result, which isn’t horrible, but there’s more to the story.

Intel also reported adjusted earnings of $0.02 per share, which fell short of the analysts’ consensus prediction of $0.10 per share. If we used non-adjusted GAAP measures, the picture looks darker, with Intel disclosing a Q2-2024 loss of $0.38 per share.

On the other hand, if we drill down to the details, it’s not all bad news for Intel. The company’s Client Computing segment revenue actually grew 9% year-over-year to $7.4 billion. Furthermore, the company’s total Intel Products revenue rose 4% to $11.8 billion, while Intel’s Foundry revenue increased 4% to $4.3 billion.

Also, Intel guided for current-quarter revenue of $12.5 billion to $13.5 billion, while analysts expect $14.4 billion. Still, the midpoint of Intel’s guidance range ($13 billion) implies revenue growth when compared to the $12.8 billion that the company reported for Q2 2024.

In any case, Intel’s results were really only “somewhat” dreadful. Come to think of it, perhaps INTC stock didn’t deserve to go down 27% in a single day. However, there’s more news to report, so buckle your seat belt, as it’s going to be a bumpy ride.

Intel’s (Not So) Shocking Layoffs and Dividend Suspension

Intel’s less-than-ideal quarterly results and revenue guidance might not be the main reason for the market’s shock and horror. I suspect that Intel’s other announcement, concerning layoffs and the company’s dividend payments, took investors by surprise.

Here’s the lowdown. First, the company revealed a cost-cutting strategy that will include laying off more than 15% of Intel’s workers. The “majority” of this headcount reduction is expected to be “completed by the end of 2024.”

Before you run for the hills, bear in mind that Intel is on a quest to reduce its expenditures. Just this year, Intel expects to reduce its gross capital expenditures by “more than 20% from prior projections, bringing gross capital expenditures in 2024 to between $25 billion and $27 billion.”

In addition, Intel announced that it will suspend its dividend payments starting in the fourth quarter of this year. Generally speaking, investors hate dividend suspensions, and that’s understandable.

However, Intel’s strategy is also understandable. It’s not shocking that the company will stop paying dividends for a while as it seeks to build out its chip-foundry business. Doing this will allow Intel to evolve into a crucial link in the world’s chipmaking supply chain.

Intel CEO Pat Gelsinger called the decisions to lay off employees and suspend the company’s dividend payments “painful and hard” but also necessary. These are measures intended to shore up Intel’s finances so that the company can establish a chip foundry and global supplier, which simply doesn’t exist in the U.S. right now. It’s basically a “pain today for profits later” scenario.

Is Intel Stock a Buy, According to Analysts?

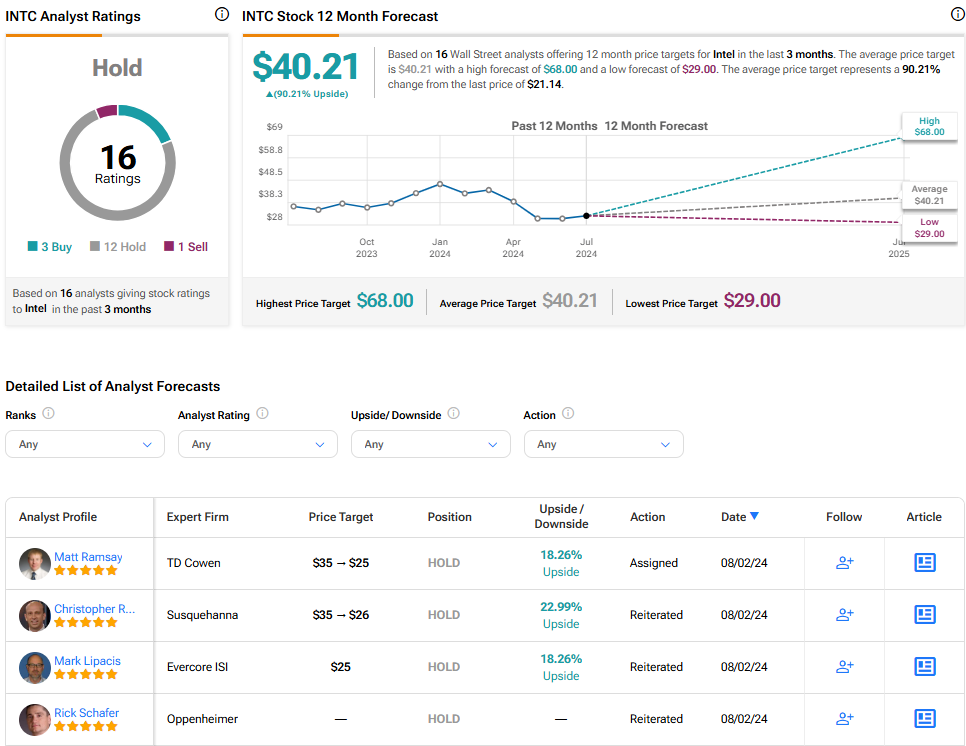

On TipRanks, INTC comes in as a Hold based on three Buys, 12 Holds, and one Sell rating assigned by analysts in the past three months. The average Intel stock price target is $40.21 (though this could change in the near future), implying 90.2% upside potential.

Conclusion: Should You Consider Intel Stock?

Intel told the market what it didn’t want to hear. As a result, Intel shares are cheaper than they’ve been in a long time. The sentiment surrounding Intel is ultra-pessimistic, and true contrarians ought to think about taking advantage of this situation.

After all, contrarian opportunities usually don’t happen until there’s bad news. Yet, the bad news shouldn’t be too shocking, given Intel’s quest to develop its chip-foundry business. Consequently, even though it won’t be a popular position, I would definitely consider buying INTC stock today.