While two-dimensional art makes sense on paper, it sort of falls apart in the real world, which is 3D all the way. But chip stock Intel (INTC) is actually fairly close to bringing 2D into the real world, as it offered up progress on a new line of transistors that measure only “a few atoms thick.” Investors were oddly unimpressed, and sent Intel shares down over 2% in Wednesday afternoon’s trading.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

While the concept of 2D transistors has been around for some time now—over a decade, at last report—actually getting them to be compatible with semiconductor manufacturing at high volumes has been a much bigger challenge. However, Intel Foundry recently offered an update that may turn that around, featuring a set of “critical process modules” that shows 2D transistors are closer than ever to prime time.

Several problems existed in trying to get 2D transistors into a 3D reality. Channels to produce them were easily damaged, especially at higher volumes of production. Processing steps that might have worked in a theoretical environment or lab setting were ill-equipped to keep up with a production line’s demands. But using a “fab-compatible contact and gate-stack integration scheme,” Intel managed to produce 2D layers, and also cap them with a series of chemical components. One highly-particular oxide etch later, and 2D transistors became that much closer to reality.

Gaudi Accelerator Code Out

Meanwhile, in a sadder note, Intel has officially abandoned the open-source code for making Gaudi accelerators run properly in a Linux environment. Intel rolled out the Habana Labs Gaudi 3 driver kernel code a little over two weeks ago at the end of November, which by itself was much later than promised. It was actually several years late, in fact.

And now, Intel has pulled back altogether from the code, which was described as “…the open-source user-space half that justifies the presence of an upstream kernel driver.” Losing this should represent a significant blow to Intel’s perception in the field at a time when it needs positive vibes from the market to recover lost market share.

Is Intel a Buy, Hold or Sell?

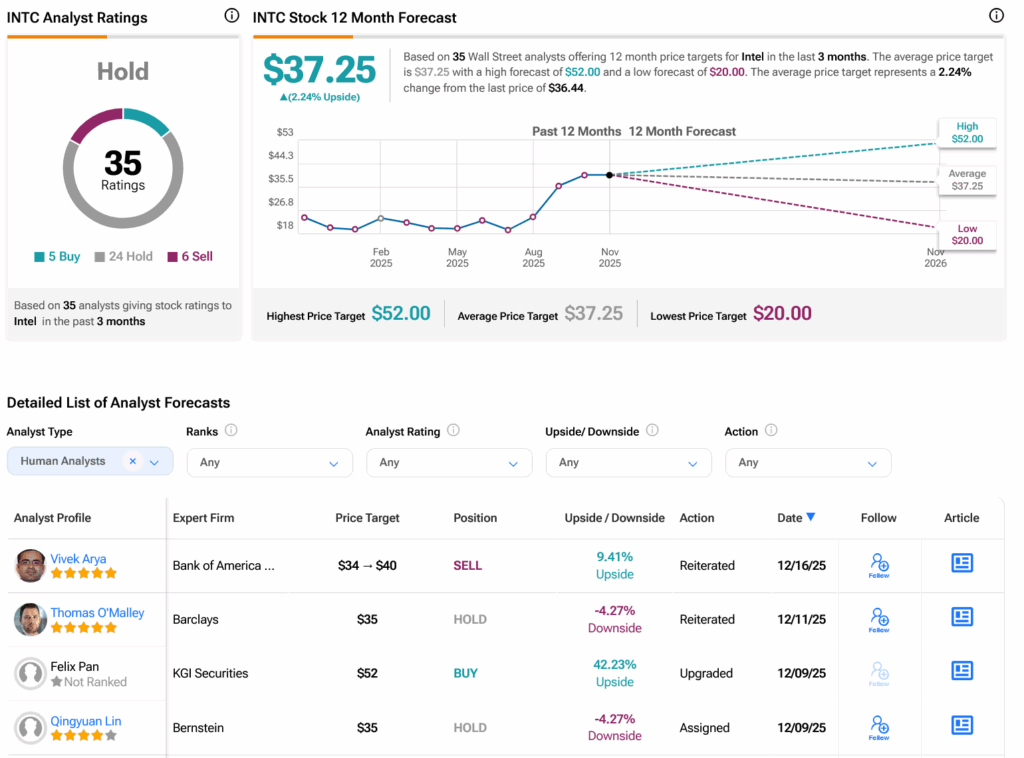

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 93.32% rally in its share price over the past year, the average INTC price target of $37.25 per share implies 2.24% upside potential.