This might be one of the biggest days that chip stock Intel (INTC) can have on its calendar. The start of the Consumer Electronics Show (CES) event in Las Vegas brings with it several days of technology developments from all across the spectrum. And Intel was not slack in its release of information. Several new developments were set to hit from the company, though investors seemed less than impressed. Intel shares notched up fractionally in Monday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Intel plans to show off the Panther Lake lineup, the latest batch of Core Ultra Series 3 processors. This is not only big news for Intel users, but also for Intel competitors; the Panther Lake lineup is the first set of chips made under Intel’s 18A process. With the arrival of these new chips comes a slate of new systems, ranging from laptops to handhelds and beyond, all powered by the Panther Lake chips.

But Intel had more to show than just Panther Lake. Intel brought out refreshed models in the Arrow Lake lineup as well, and an early look at new graphics processors (GPUs) in the Arc dGPU lineup like the Arc B770. Intel also plans an early look at its work in artificial intelligence (AI), all of which will be shown off throughout the week and at Intel’s opening remarks later today.

Melius Boost

Analysts seem increasingly pleased with Intel these days, and Melius Research came out in its favor as well. Melius, via analyst Ben Reitzes—who has a four-star rating on TipRanks—upgraded Intel from Hold to Buy, and also hiked the price target from its original $44 to $50.

Perhaps the biggest reason for Reitzes’ reconsidering is the 14A process, which is set to go live next year. CEO Lip-Bu Tan’s business relationships do not hurt either. Reitzes noted, “There is a good chance that Nvidia (an Intel shareholder) and Apple take a hard look at producing chips on the 14A node by 2028/2029 and this news could fully filter into the stock as we go throughout 2026, driving higher book value.”

Is Intel a Buy, Hold or Sell?

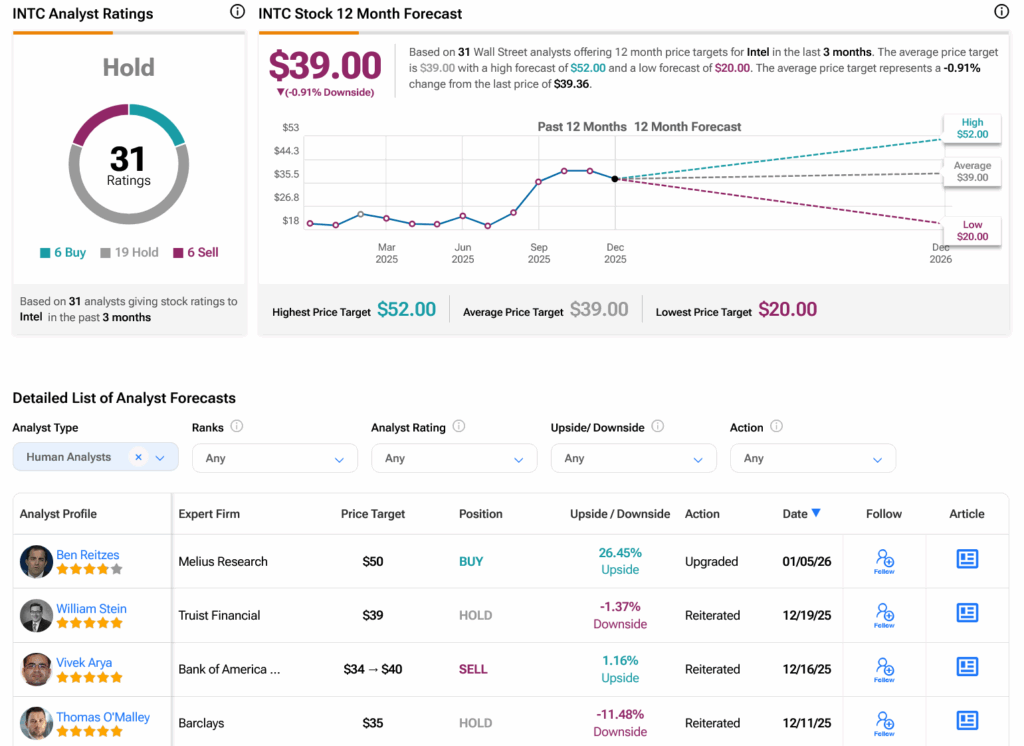

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on six Buys, 19 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 98.19% rally in its share price over the past year, the average INTC price target of $39 per share implies 0.91% downside risk.