There is some exciting news out around chip stock Intel (INTC) right now, featuring one of Intel’s production operations in particular. That production venue is known as Fab 52, and it has some big plans for 2026. These plans caught investors’ eye, and they responded accordingly. Intel shares increased modestly in Monday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

We heard about Fab 52 last week, and it was a particularly potent foundry operation. Reports even suggested that it was bigger than rival TSMC (TSM) Fab 21 phase one, and the upcoming Fab 21 phase two combined. But today, we found out just what kind of output Intel’s new powerhouse fab unit was looking to put out.

Fab 52 is looking to put out “40,000 wafers per month,” reports note, and it even has an eye on producing “advanced yield by 2027.” Right now, Fab 52 is looking to start production on the Panther Lake series of chips, and should start delivering high-volume yields in the months ahead.

Campus Expansion

Meanwhile, Intel—which spent several months aggressively cutting costs and paring back operations—announced plans to expand one operation: the Bowers campus in Santa Clara. Reports note that Intel is looking to add a new fabrication building measuring three stories in height backed up by a central utility building (CUB).

The combination of the fab building and the CUB together, reports note, would give Intel an extra 107,000 square feet of space, roughly. The fab building is set to handle electrical operations, storage, and tool facilities. The CUB, meanwhile, keeps chillers, cooling towers, and similar equipment in place. The project is being used as a way to put more space into production rather than shifting to larger office space, reports note.

Is Intel a Buy, Hold or Sell?

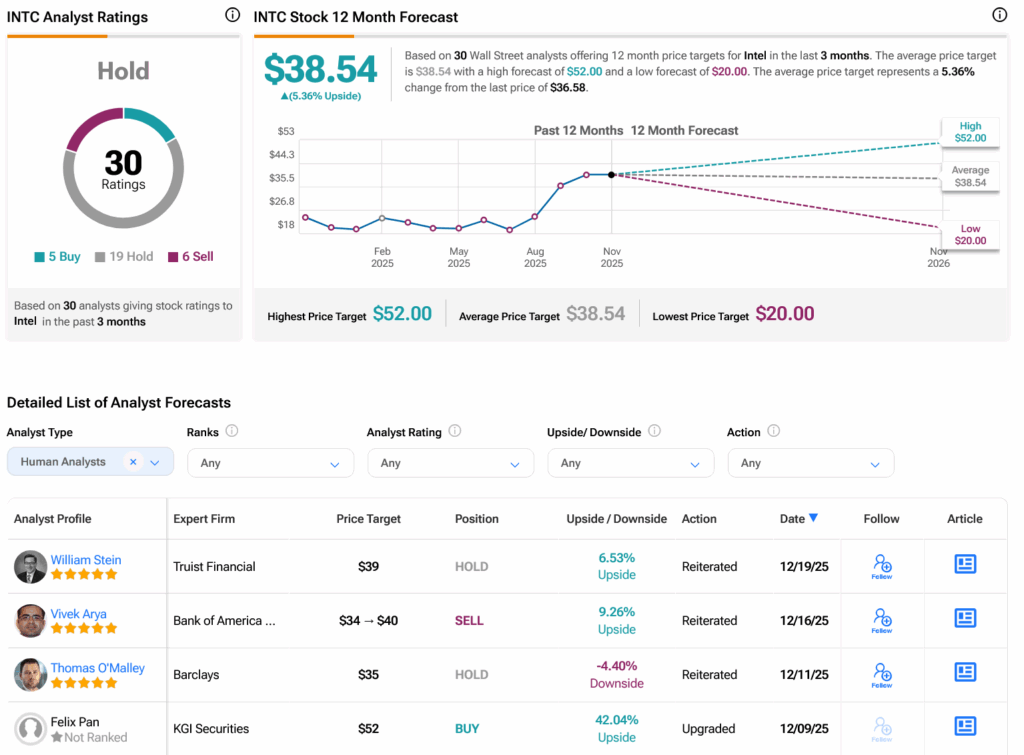

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on five Buys, 19 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After an 82.64% rally in its share price over the past year, the average INTC price target of $38.54 per share implies 5.36% upside potential.