Sometimes, you just have to wonder what investors are looking for. Chip maker Intel (NASDAQ:INTC) announced that it was setting up a new partnership arrangement to improve chip production and make the process more efficient. However, that failed to excite investors, as Intel shares were down modestly in Thursday afternoon’s trading.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Intel turned to electronics company Sharp (OTHEROTC:SHCAY) for an assist here because of an unexpected wrinkle in Sharp’s production layout. As it turned out, Sharp had excess capacity. Specifically, some of its LCD plants in Japan were going under-utilized, and that gave Intel an opportunity to slip in and take over some of that capacity for itself. That will give Sharp extra income and give Intel an opportunity to research semiconductor production methods.

Since Intel will focus on “back-end chip production processes,” there is further potential to produce more chips. With several other companies looking to Intel for production, that could be a major step forward.

Part of a Wider Ambition

We know that Intel is already looking to build chips for Nvidia (NASDAQ:NVDA), and that’s a major move in and of itself. But Intel isn’t stopping there. It’s out to, as CEO Pat Gelsinger put it, “…build everybody’s chips, everybody’s AI chips.” And Intel is out to recover, too; it was the biggest chipmaker in the world until 2017 when Samsung took over the number one slot. Since then, it’s ramped up its ambitions as a foundry and is eagerly looking for new opportunities to build chips for everyone who can legally write a check.

Is Intel a Buy, Sell, or Hold?

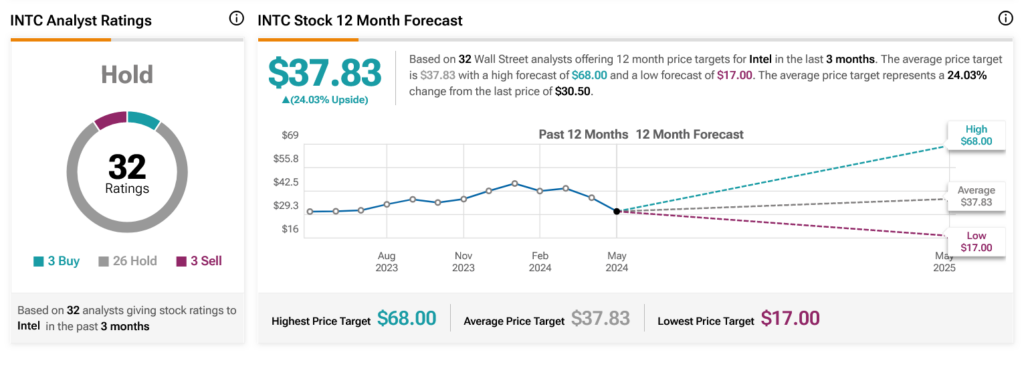

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 26 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 1.35% loss in its share price over the past year, the average INTC price target of $37.83 per share implies 24.03% upside potential.