While we were all starting to wonder about chip stock Intel (INTC) and its plans for the Battlemage line-up, there are signs that the new processor will be arriving soon. And that news certainly brought cheer to shareholders, as shares were up nearly 2%.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The latest word from Tom’s Hardware says that a leak out of Intel puts the Battlemage launch, complete with a special event, in December. This would actually see the Battlemage launch before AMD’s (AMD) RDNA 4 and Nvidia’s (NVDA) Blackwell processors. This is not the first time we have heard such supposition kick-in, as an earlier report suggested that December was likely the day of choice for the Battlemage rollout.

However, it is worth noting that a lot of this is built on leaked information. The fact that Intel itself is playing this comparatively close to the vest does not bode well for the Battlemage, as well as its future incarnations called the Alchemist, the Celestial, and the Druid.

Processor Sales Drop

Separately, Amazon (AMZN) does not feature one Intel processor in its roster of 10 best-selling microchips. However, AMD is selling three different generations of processors. It is a similar story at Newegg, where the 9800X3D just seized the top spot.

Finally, another blow to the gaming community came from Intel as a potential counter to AMD’s 3D V-cache emerged. The good news is it looks like “a large L3 cache” is the solution of the day. The bad news is that change will be aimed primarily at data centers. AMD GPUs, the report notes, are geared mainly toward gamers, which puts Intel at something of a disadvantage once more.

Is Intel Stock a Buy?

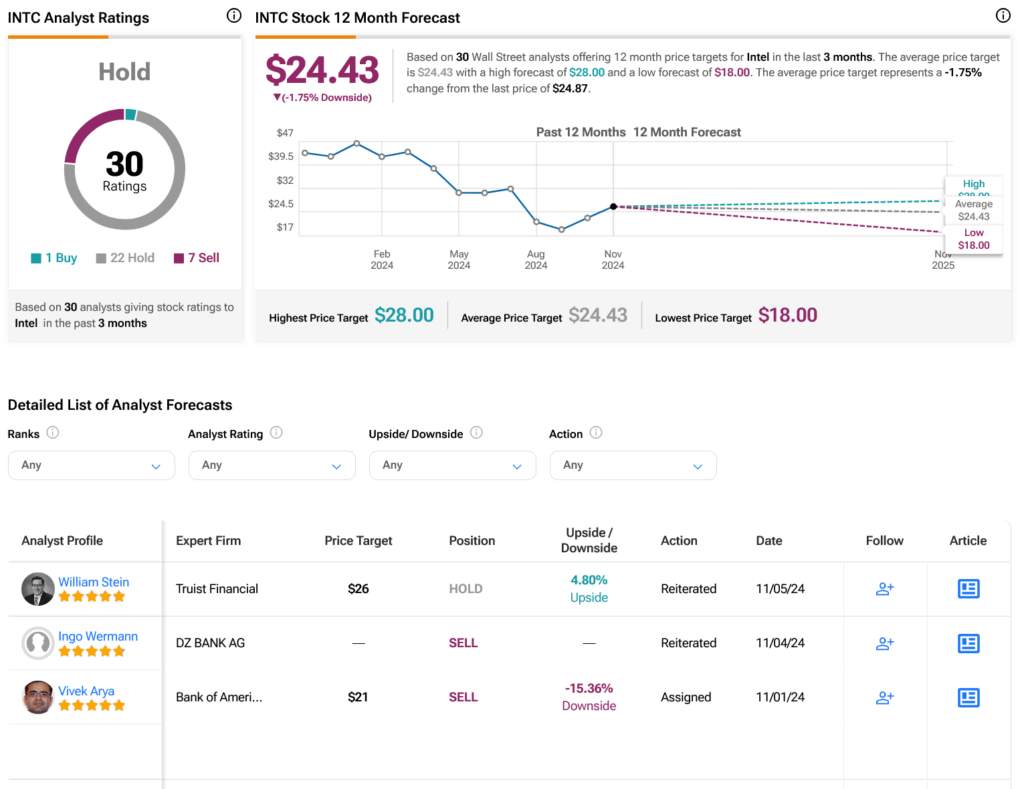

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 22 Holds and seven Sells assigned in the past three months, as indicated by the graphic below. After a 43.81% loss in its share price over the past year, the average INTC price target of $24.43 per share implies 1.75% downside risk.