Remember how we heard that chip stock Intel (INTC) was going to need clients if it was going to get anywhere with its foundry processes? New reports suggest it may have a doozy of a new partner in the wings with none other than electric car giant Tesla (TSLA). Any good news is particularly good news for Intel at this point, and shareholders responded by sending Intel shares up nearly 2% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New reports suggest that Tesla has taken an interest in working with Intel and bringing Intel’s 18A process node to develop a line of “custom AI chips.” This would be alongside Tesla’s current deal with Samsung (SSNLF), giving Tesla one more supplier.

Naturally, nothing is firm yet on this deal. But we have long heard about Intel’s custom silicon interest, and it is no secret that Elon Musk likes working with companies that are in line with his “area of business.” Reports also suggested that Tesla might have an interest in Intel for “packaging services” as well. Only time will tell if this turns out to be a solid development or not, but it certainly stands as a point to keep watch for going forward.

“Intel’s Got Real Problems”

And then, CNBC analyst Jim Cramer made another pass to talk about Intel, and not exactly confidently. Cramer’s recent discussion of Intel was, perhaps, a bit unfocused. But the last seven words really struck a chord: “Intel crushed them [Synopsys (SNPS)], I think. I think Intel crushed them. I really do because when you look at the China…they have been very close to Intel, Intel Foundry. Intel’s got real problems, I don’t know.”

Cramer’s recent remarks about Intel have been somewhat mixed. While he is sure that Lip-Bu Tan is capable of doing the job, he also advised caution after some recent gains in Intel stock, suggesting that the gains might not be sustainable going forward.

Is Intel a Buy, Hold or Sell?

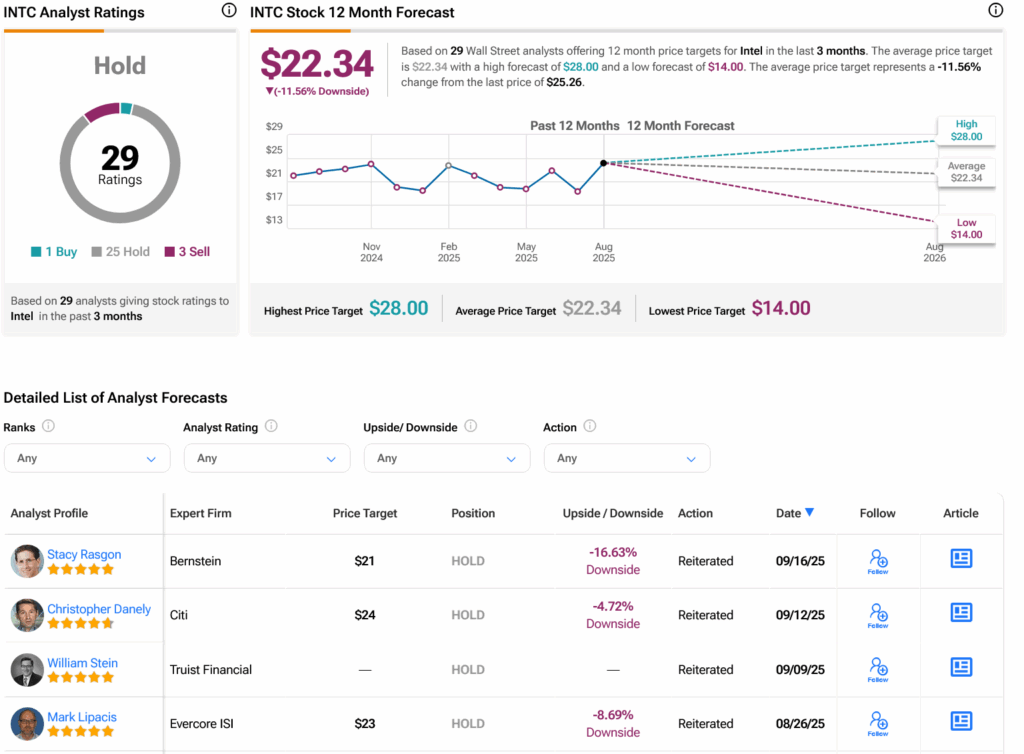

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 25 Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 15.37% rally in its share price over the past year, the average INTC price target of $22.34 per share implies 11.56% downside risk.