A sharp increase in buying on the part of institutional investors is driving the price of Bitcoin (BTC) to new all-time highs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

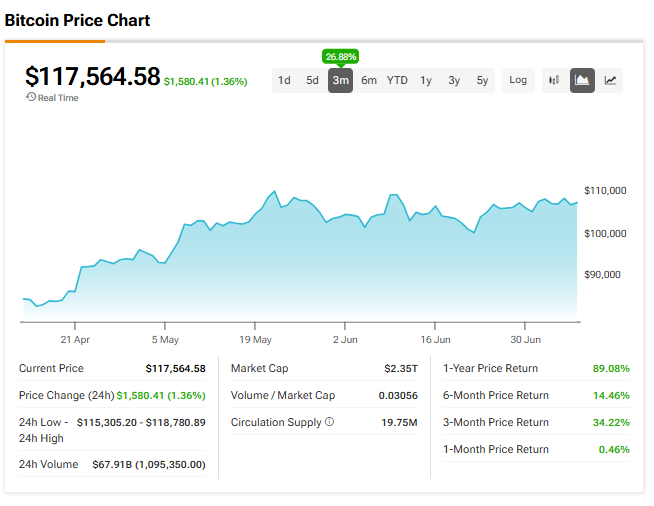

The largest cryptocurrency by market capitalization has risen 4% in the past 24 hours to trade at just over $118,000, the latest all-time high reached in the past week. Bitcoin traded as high as $118,740 early on July 11 before pulling back to change hands at $118,135.14.

Analysts say that the price of BTC is being driven sharply higher as a growing number of institutions join retail investors in buying Bitcoin. In particular, institutions are piling into Bitcoin exchange-traded funds, such as BlackRock’s (BLK) iShares Bitcoin Trust (IBIT). On July 10, Bitcoin ETFs recorded their biggest day of inflows this year at $1.18 billion.

Supportive Environment

Despite the big move higher in recent days, analysts see more gains ahead for BTC, saying that the current environment remains supportive of cryptocurrencies. Expectations for a September rate cut from the U.S. Federal Reserve, the strong inflows into spot crypto ETFs, and bullish sentiment among retail investors should continue to drive the current rally.

A growing number of futures traders are betting that Bitcoin’s price will quickly surpass $120,000, while options traders are taking out bets on the price exceeding $130,000 by September of this year. Other cryptocurrencies are also marching higher, with the price of Ethereum (ETH) trading above $3,000 for the first time in four months.

Is BTC a Buy?

Most Wall Street firms don’t offer ratings or price targets on cryptocurrencies such as Bitcoin, so we’ll look instead at its three-month performance. As one can see in the chart below, the price of BTC has risen 26.88% in the last 12 weeks.