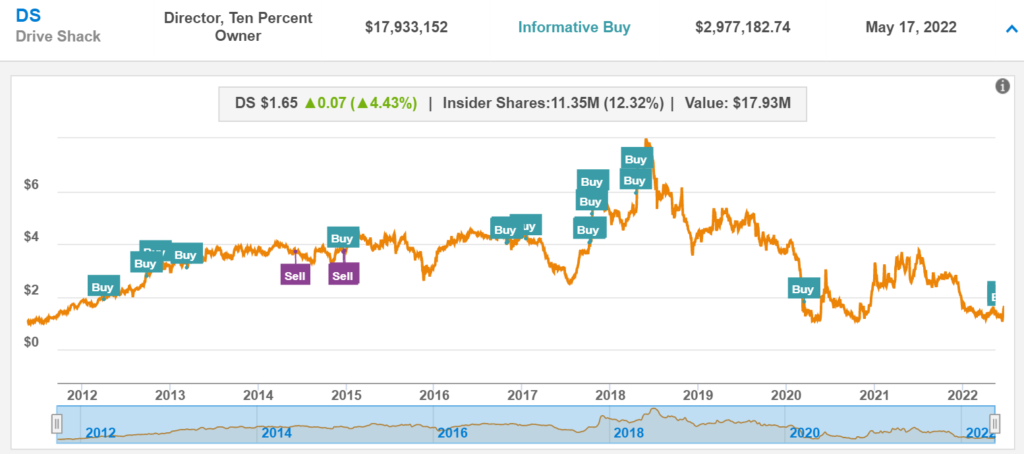

Drive Shack’s (DS) Director Wesley Edens has purchased the company’s shares for the second time this month. On May 17, Edens made an informative buy of DS’ 2 million shares worth about $2.98 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Edens has been the Chairman of Drive Shack’s board of directors since its inception. He has also served the company as its CEO until February 2007.

On May 13, Edens purchased 2 million shares of Drive Shack for $2.27 million. As per the data collected by TipRanks, he has been consistently increasing his holdings of DS stock since 2016. The total value of Edens’ Drive Shack holdings now stands at about $17.9 billion.

Near-Term Growth Prospects

Headquartered in New York, the company engages in golf-related leisure and entertainment businesses. Drive Shack was founded in June 2002. The stock is up 31% over the past three months.

Recently, Drive Shack reported its first quarter of 2022 results. Revenues climbed 12.9% year-over-year to $69 million. However, it reported a loss of $0.22 per share, wider than the loss of $0.15 per share reported in the same quarter last year. Also, the company failed to beat the consensus loss estimate of $0.14 per share.

The company has been actively investing in new venues as it finds scope for near-term growth. “We are on track to open seven locations by the end of 2022, with our next venue planned to open in Washington DC’s Penn Quarter next month, followed by our Houston and Chicago locations which are planned to open in the third quarter,” said President and CEO of Drive Shack, Hana Khouri.

Khouri added, “We continue to experience strong momentum at our venues and courses as our walk-in business has largely normalized. Total event revenue is up meaningfully to last year’s first quarter and the demand for future events remains exceptionally strong across our entire brand portfolio.”

Stock Rating

Last week, Craig-Hallum analyst Greg Palm lowered the price target on Drive Shack to $3 while maintaining a Buy rating. The price target implies 81.8% upside potential from current levels.

Overall, the consensus among analysts is a Strong Buy based on three unanimous Buys. Drive Shack’s average price forecast stands at $4.33, implying upside potential of 162.4% to current levels.

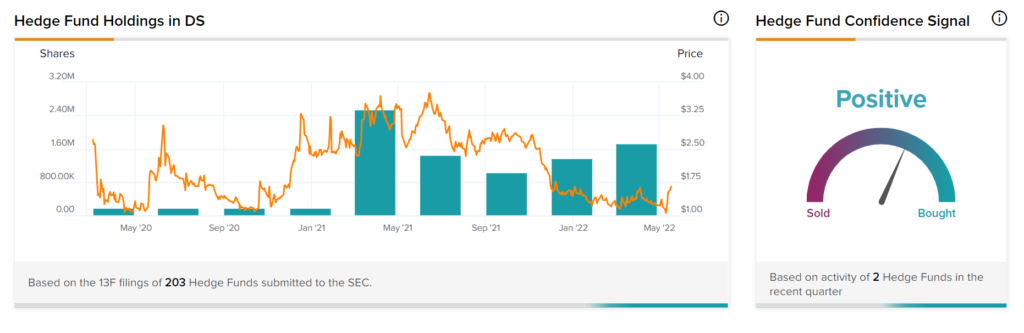

Hedge Funds’ Activity on TipRanks

Over the past year, hedge funds have been increasing their stakes in Drive Shack, which indicates that they are Positive about the stock. Meanwhile, the cumulative change in holdings across the two hedge funds that were active in the last quarter was an increase of 359,500 shares.

Takeaway

Which stocks will gain and which will lose? The Hedge Fund tool helps savvy investors gauge likely future stock movement.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

TipRanks’ Hedge Fund Tool Hinted at Dalio’s Move to Part Ways with Tesla

Why Are Top Insiders Selling Meta Stock?

Home Depot Hits Home Run with Solid Q1 Results