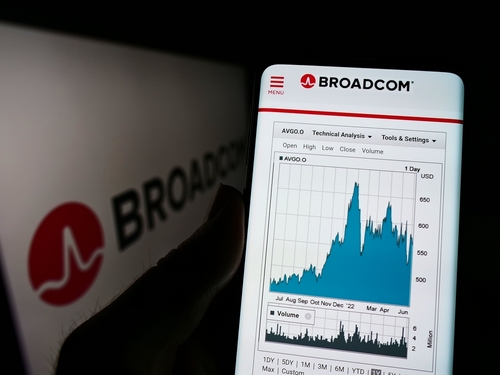

New insider activity at Broadcom ( (AVGO) ) has taken place on December 29, 2025.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

President & CEO Hock Tan has executed a significant insider transaction, selling 100,000 shares of Broadcom stock in a move valued at $34,564,286. This sizable sale by the company’s top executive highlights a major cash realization from his holdings, drawing attention from investors tracking insider activity at Broadcom.

Spark’s Take on AVGO Stock

According to Spark, TipRanks’ AI Analyst, AVGO is a Outperform.

Broadcom’s overall stock score reflects its strong financial performance and positive earnings call sentiment, driven by growth in AI semiconductors and infrastructure software. While the technical analysis shows mixed signals, the company’s strategic focus on AI and robust cash generation support a positive outlook. The high P/E ratio indicates a premium valuation, which may pose a risk if growth expectations are not met.

To see Spark’s full report on AVGO stock, click here.

More about Broadcom

YTD Price Performance: 53.26%

Average Trading Volume: 28,417,012

Technical Sentiment Signal: Buy

Current Market Cap: $1669.5B