Bala Purushothaman, Chief Human Resources Officer of Procter & Gamble (PG), recently sold shares worth $2.16 million of the company. PG is a global consumer goods company known for its wide range of brands in personal care, household products, and health care.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Insider sales can sometimes indicate a lack of confidence in a company’s future. However, it’s important to understand that there are many reasons for these sales, and not all are bad. For example, insiders might sell shares to meet personal financial needs or to diversify their investments.

A Closer Look at the Insider’s Transactions

According to the most recent SEC filing, Purushothaman divested 12,800 shares of PG on October 24 at $168.985 per share. Simultaneously, he exercised an option to purchase the same number of shares at a significantly lower price of $91.07 per share. Following this latest transaction, he still owns P&G’s shares worth roughly $2.71 million.

It is worth mentioning that in August, he sold 10,837 shares for a total transaction value of $1.81 million. Before this, the insider sold PG stock worth $4.58 million and $2.19 million in April and January, respectively.

Insider Sale Follows Decline in P&G’s Q1 Sales

The sale by P&G’s key executive occurred just over a week after the company released mixed results for the fiscal first quarter. Procter & Gamble’s sales dropped 1% year-over-year and missed analysts’ expectations due to weakness in the Beauty as well as Baby, Feminine, and Family Care segments.

Nevertheless, organic sales, which exclude the impact of forex and acquisitions, rose 2%. Further, the company expects Fiscal 2025 organic sales to grow in the range of 3% to 5% year-over-year.

Insiders Sentiment for PG Stock Is Negative

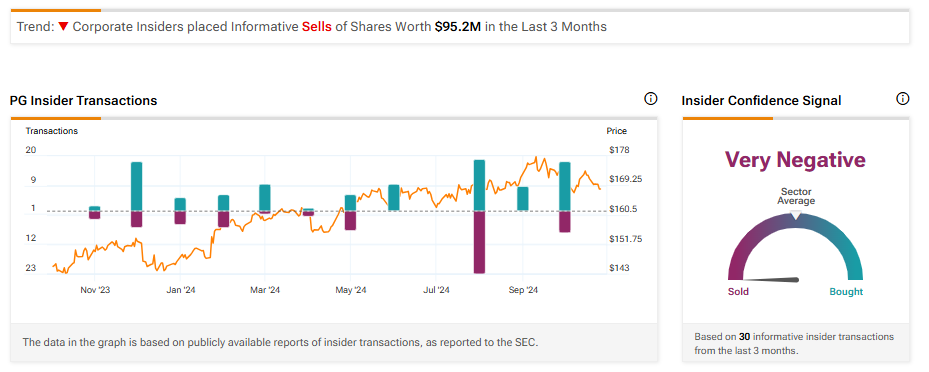

Importantly, Purushothaman is not the only one who reduced his stake in the company. Based on 30 informative insider transactions from the last three months, corporate insiders have sold $95.2 million worth of PG stock. Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Very Negative.

Investors may benefit from keeping an eye on transactions made by key insiders, as these transactions typically reflect their confidence in the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is PG Stock a Good Buy Now?

Turning to Wall Street, PG stock has a Moderate Buy consensus rating based on 12 Buys and nine Holds assigned in the last three months. At $179.72, the average Procter & Gamble price target implies a 6.84% upside potential. Shares of the company have gained 17.65% year-to-date.