Kelcy L. Warren, Executive Chairman of Energy Transfer (NYSE:ET), is bullish on ET’s future as he recently purchased shares of the company. Energy Transfer is a provider of natural gas pipeline transportation and transmission services. It is worth mentioning that Warren co-founded ET in 1996.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Going by the SEC filing, Warren bought a total of 3 million shares of the company on August 17, August 18, and August 21. The weighted average price of these purchases is $12.96 per share. The transaction’s total consideration stands at $38.89 million.

As per the data collected by TipRanks, Warren has been consistently increasing his holdings in ET stock over the past few years. The total value of his holdings now stands at about $3.86 billion.

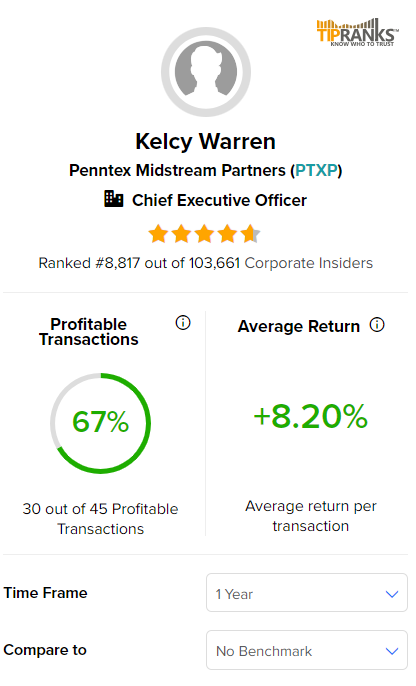

Additionally, Warren has had a 67% success rate in his 45 transactions over the past year, with an average 8.2% return per transaction.

Recent Developments

It’s worth highlighting that Warren’s purchase of ET stock came despite the company’s disappointing second-quarter results released on August 3. While the company missed both earnings and revenue estimates, it raised the adjusted EBITDA outlook for the full year 2023.

Following the earnings release, Energy Transfer announced plans to acquire Crestwood Equity Partners (CEQP) in an all-stock deal worth $7.1 billion. The deal is expected to bolster ET’s presence in the Williston and Delaware basins.

Bullish Insider Confidence Signal

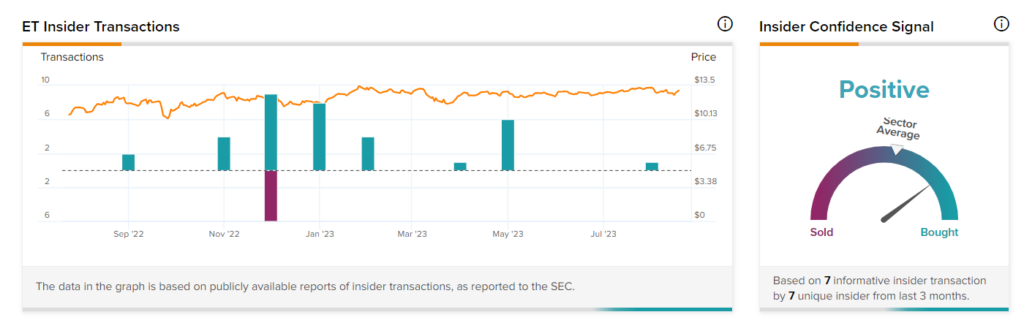

Overall, corporate insiders have bought ET shares worth $58.2 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Energy Transfer is currently Positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is ET a Good Stock to Buy?

On TipRanks, ET stock commands a Strong Buy consensus rating based on six unanimous Buys. The average Energy Transfer stock price target of $17.83 implies 37.15% upside potential.

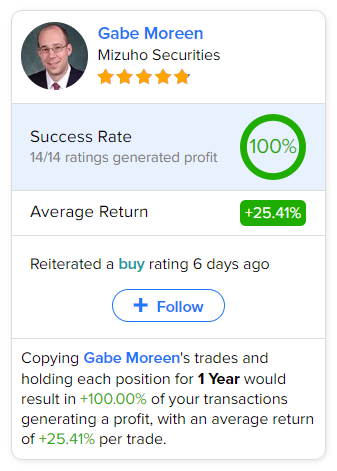

Investors looking to buy ET stock could follow its most accurate analyst on TipRanks, analyst Gabe Moreen of Mizuho Securities. Moreen has a track record of 100% success, with all 14 of his ratings on ET stock having generated a profit over a one-year time frame. Replicating his trades for the said period could result in an average return of 25.41% per trade.