Inhibrx Biosciences (INBX) stock is surging over 60% in premarket today after the company reported positive results from a Phase 2 trial of its cancer drug Ozekibart (INBRX-109). The study showed major progress in patients with conventional chondrosarcoma, a rare and aggressive form of bone cancer.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the company, Ozekibart reduced the risk of disease progression or death by 52% compared with placebo. Median progression-free survival improved from 2.66 months to 5.52 months, more than doubling the previous standard. The disease control rate was also higher at 54%, compared with 27.5% for placebo.

The strong trial results drove heavy buying in INBX stock, as traders expect possible fast-track review or partnership interest from larger drugmakers.

A Big Step for Rare Cancer Treatment

Chondrosarcoma is one of the most difficult bone cancers to treat, with limited therapy options and a poor prognosis. Inhibrx said it plans to discuss the Phase 2 data with the U.S. Food and Drug Administration (FDA) as it prepares a Biologics License Application (BLA), targeted for submission in the second quarter of 2026.

The company noted that Ozekibart works by targeting the DR5 (Death Receptor 5) pathway, which triggers cell death in tumor cells. This makes it the first investigational therapy to show a significant survival benefit for chondrosarcoma in a randomized study.

Is INBX Stock a Buy, Sell, or Hold?

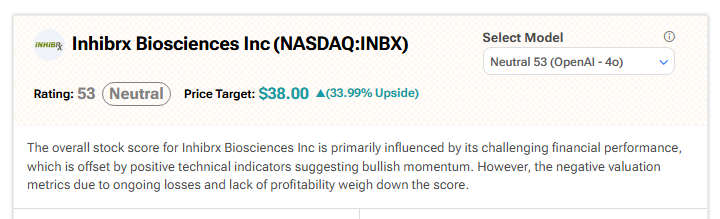

Turning to Wall Street, analyst coverage of Inhibrx Biosciences is limited. Fortunately, TipRanks’ AI analyst has reviewed the stock. The AI analyst rates INBX Neutral (53) with a $38 price target, suggesting about 34% upside.

The rating reflects weak financial performance and ongoing losses, partly offset by bullish technical indicators showing some positive momentum. However, negative valuation metrics and lack of profitability continue to weigh on the score.