President Donald Trump has blocked a $3 million deal tied to U.S. chip assets, citing security concerns linked to China. The decision affects photonic company HieFo Corp and assets once owned by Emcore Corporation. According to the White House, the deal raised risks tied to foreign control of sensitive chip work.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Specifically, Trump said HieFo is controlled by a citizen of China. As a result, the deal was seen as a possible threat to U.S. security. The order requires HieFo to divest all related Emcore assets within 180 days.

Why This Matters for Chip and Defense Firms

The review was handled by the Committee on Foreign Investment in the U.S., also known as CFIUS. While the group confirmed a risk was found, it did not share details. Still, the move shows how strict U.S. oversight has become in the chip and defense areas.

Notably, the deal value was small, at under $3 million. However, the assets included chip production and wafer work used in aerospace and defense. As a result, size did not reduce scrutiny.

Meanwhile, Emcore said it sold its chip unit and wafer operations to HieFo for about $2.92 million. At the time, Emcore was publicly traded, though it was later taken private. HieFo said a former Emcore engineer and a former Emcore sales head co-founded it.

Overall, the decision signals that even modest chip deals can face blocks if China ties are involved. For investors, this reinforces that U.S. chip policy remains tight and focused on control rather than price.

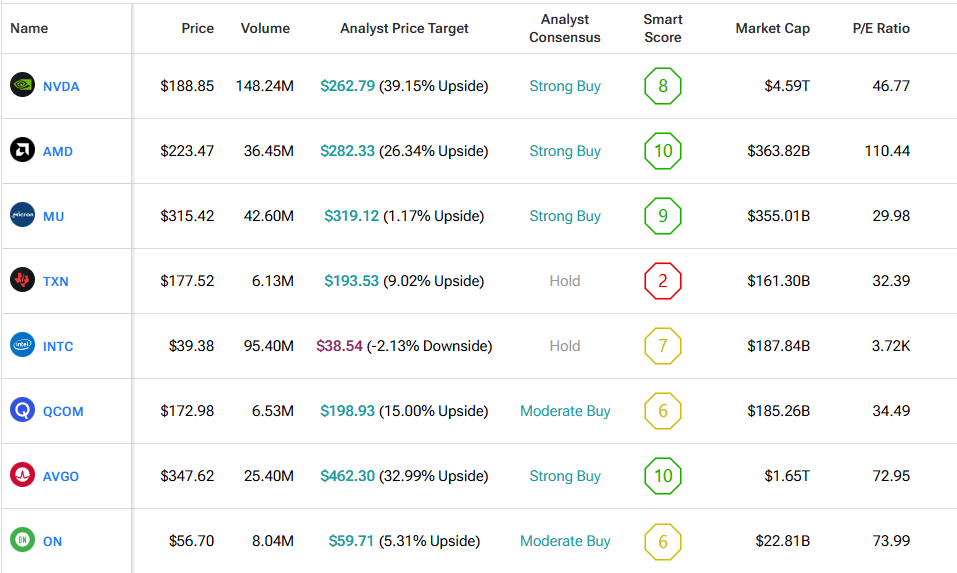

We used TipRanks’ Comparison Tool to identify notable chip companies affected by Trump’s tightened export rules on chipsto China. It’s a great tool to gain an in-depth look at each stock and the American chip industry as a whole.