Immunic (IMUX) is a clinical-stage biotechnology company focused on developing small-molecule therapies for treating chronic inflammatory and autoimmune diseases. In our last few articles, we saw how Immunic is exploring treatments for Multiple Sclerosis (MS) and Celiac Disease with its lead drug candidate, Vidofludimus Calcium.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Recently, TipRanks hosted a call with Immunic’s President and CEO Dr. Daniel Vitt, in which he shared some very interesting insights about the company’s current and future potential. In today’s article, which is Part 1 of a two-part article based on the CEO’s interview, we will drive you through some of the key highlights from the call. Importantly, we will look at why Dr. Vitt believes that Immunic’s “risk profile got very attractive over time” and why this could possibly be the right time to consider investing in the stock.

Why Immunic Was Formed

Immunic was founded in 2016 with the idea that there is a dearth of safe oral drugs for treating chronic autoimmune diseases such as Multiple Sclerosis and Ulcerative Colitis. The team aimed to develop new molecule technology-based medicines for diseases with high unmet needs to improve patients’ lives.

Immunic officially became a company in 2017, when Dr. Andreas Muehler (Chief Medical Officer) met with Hella Kohlhof (Chief Scientific Officer) and Dr. Vitt with a common mindset. The three together complemented the chemistry, biology, and medicine aspects of the team.

Timeline of Key Milestones

Dr. Vitt noted some of the upcoming key milestones on which both Immunic’s and its stock’s performance are dependent. These include:

- Phase 2 CALLIPER trial – Readout of the brain volume data of the full 467 CALLIPER patient population in April 2025 for the treatment of Progressive MS (PMS).

- The Phase 3 CALLIPER trial reading, which is expected in 2026. The company has yet to begin the trial on an estimated 2,100 patients suffering from PMS.

- Commercialization of IMU-838 (vidofludimus calcium) as a proven oral, small-molecule drug for treating MS and its subtypes after receiving FDA clearance.

Immunic vs. Well-Established Pharma Companies

When asked about the distinguishing factors between Immunic as a developmental-stage company compared to the well-established pharma players such as Johnson & Johnson (JNJ), Pfizer (PFE), and Amgen (AMGN), here’s what Dr. Vitt believes.

Dr. Vitt says that Immunic is addressing a huge market with an unmet need. For example, IMU-838 is the first oral candidate that has shown indication (statistical relevance) in preventing brain neurons from dying. This, in turn, reduces the early setting-in of disabling conditions in patients and could help them live longer, independent lives. Meanwhile, the other available drugs for treating MS simply focus on preventing MS relapses.

Highlighting the huge opportunity for Immunic, Dr. Vitt noted that the MS drug market stands at roughly $23 billion, as of date. Furthermore, if Immunic’s drug gets commercialized, Dr. Vitt is looking at $3 to $4 billion in annual sales. Such substantial sales will obviously benefit the company’s share price. He anticipates at least a 10x jump in share price if the MS drug is approved as a commercial medicine.

Dr. Vitt believes that the blue-chip pharma companies already have an established pipeline of proven drugs. While some of the pharma giants are expected to benefit from the massive potential for GLP-1 weight loss drugs, Dr. Vitt believes that this optimism is already priced into their stocks. Overall, stocks of bigger players have lower volatility and hence, present fewer opportunities to deliver higher price appreciation for shareholders.

What Is the Price Target for Immunic?

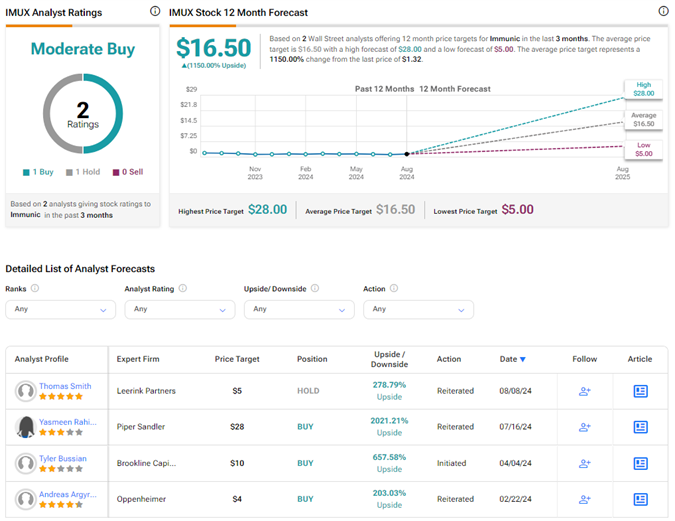

On TipRanks, the average Immunic price target of $16.50 implies an attractive 1150% upside potential from current levels. Also, IMUX has a Moderate Buy consensus rating based on one Buy versus one Hold rating. Year-to-date, IMUX shares have declined 12%.

This article was written in partnership with Immunic. TipRanks may be compensated for its publication.