Biotech company Illumina (NASDAQ:ILMN) sank in pre-market trading on Friday after the gene sequencing firm’s outlook left investors disappointed. The company now expects its FY23 revenues to decline by 2% to 3% year-over-year versus its prior expectation of revenues remaining flat. Core Illumina revenues are likely to fall by 3% to 4% year-over-year, while revenues for its GRAIL business segment are projected to be in the low end of the firm’s $90 million to $110 million range.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In addition, its adjusted loss in FY23 is anticipated to be between $0.60 to $0.70 per share.

Jacob Thaysen, Illumina’s CEO, commented on the lowered outlook, stating that he remains confident in the firm’s ability to achieve long-term success. In addition, management will remain focused on boosting consumables demand.

In the third quarter, the company’s revenues remained flat year-over-year at $1.12 billion as compared to analysts’ estimates of $1.13 billion. Its adjusted earnings came in at $0.33 per share, surpassing analysts’ consensus estimates of $0.13 per share.

Is ILMN a Good Stock to Buy?

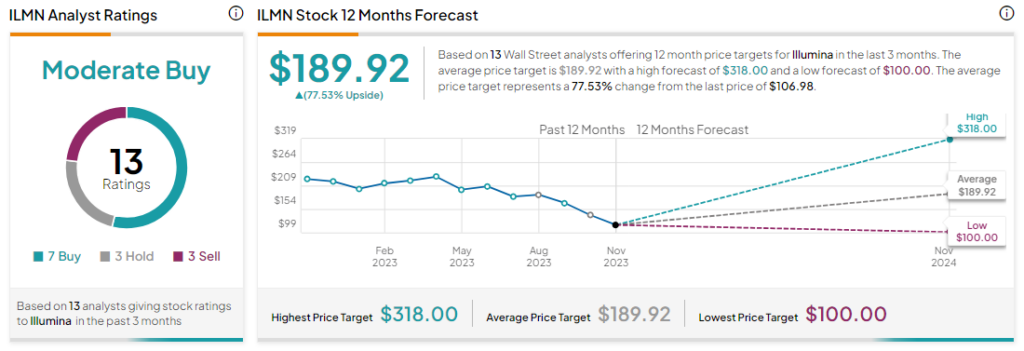

Analysts remain cautiously optimistic about ILMN stock, with a Moderate Buy consensus rating based on seven Buys, three Holds and three Sells. The average ILMN price target of $189.92 implies an upside potential of 77.5% at current levels.