Shares in Holiday Inn owner InterContinental Hotels (IHG) booked a 3% drop in trading today despite announcing a huge share buyback and a new acquisition.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

When $900 Million Just Isn’t Enough

The group, reporting its 2024 annual results, revealed that a resurgence in post-pandemic travel had helped it reach $2.3 billion in revenues, up 7% on 2023 figures. Adjusted earnings per share (EPS) came in up 15.1%. It also announced a new $900 million buyback program, which together with ordinary dividend payments is expected to return over $1.1 billion to shareholders in 2025. IHG also announced the $124.2 million acquisition of Ruby Hotels, a European urban lifestyle brand, which it wants to expand into the Americas and Asia.

However, analyst Jamie Rollo of Morgan Stanley maintained a sell rating on the stock, declaring that the $900 million fell short of market expectations of $1 billion. He was also disappointed by free cash flow experiencing a 22% decline, attributed to increased capital expenditure and system fund requirements. He added that while the group’s RevPAR growth and EBIT margins showed modest improvements, the lack of guidance and the small acquisition of the Ruby hotels brand had not been enough to bolster confidence in the stock’s performance.

Fears Over Valuation

Jaina Mistry, analyst at Jefferies, maintained a Hold rating on the stock, expressing concerns over the group’s valuation, which currently sits at $20 billion. Mistry said the valuation seemed “full.” In addition, Mistry needed more clarity on guidance related to RevPAR and was concerned about higher interest costs and increased key money expenses.

Is IHG a Good Stock to Buy?

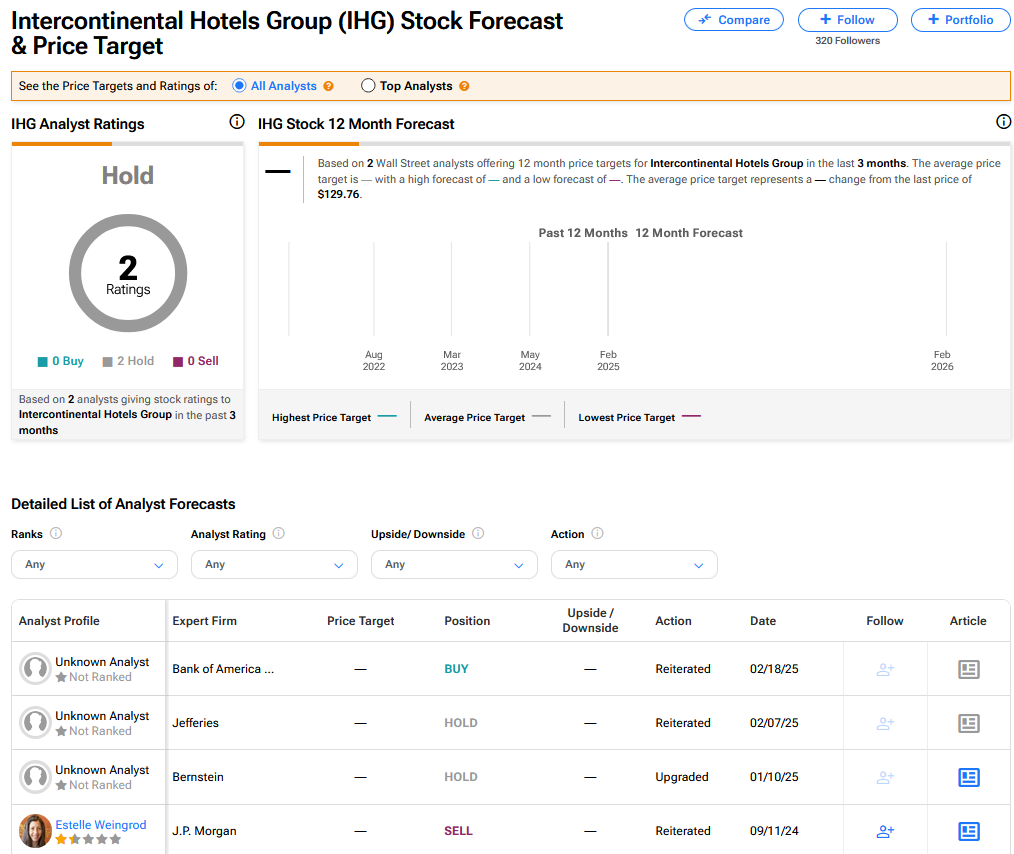

On TipRanks, IHG has a Hold consensus based on 2 Hold ratings.