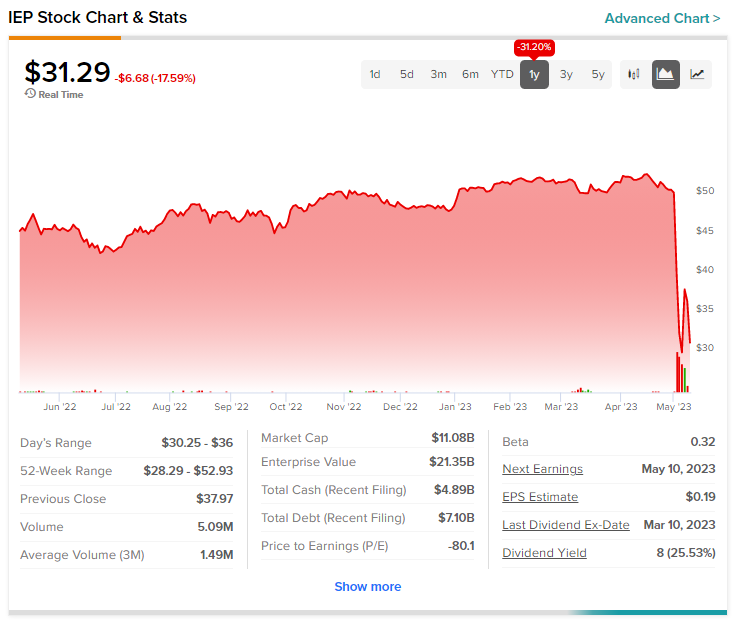

Icahn Enterprises (NASDAQ:IEP) shares are nosediving today after the diversified holding company announced first-quarter numbers alongside key business updates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company generated $2.6 billion in revenue with a net loss per depository unit coming in at $0.75. Analysts were expecting a net income per depository unit of $0.19 on revenue of $2.56 billion for the period. Net asset value for the quarter remained largely unchanged at $5.6 billion.

Further, the company’s board has approved a quarterly distribution of $2 per depository unit. The record date for the distribution is set for May 22.

In a major development, the company disclosed that it was recently contacted by the U.S. Attorney’s Office (Southern District of California) for information associated with the corporate governance, capitalization, valuation, and due diligence (among other things) for its affiliates as well as Icahn Enterprises.

The company is cooperating with the request, which comes after the earlier release of a short seller report by Hindenburg Research.

In the report, Hindenburg had alleged that IEP had inflated the value of its assets, and shares of the company have tanked nearly 40% so far this month.

Read full Disclosure