Tech giant IBM (IBM) is planning to lay off thousands of employees this quarter as it shifts more of its focus toward faster-growing parts of the business, according to Bloomberg. More precisely, a spokesperson said that the company regularly reviews its workforce in order to make sure it fits business goals and sometimes adjusts accordingly. This time, the changes will affect a small portion (described as a “low single-digit percentage”) of IBM’s total global employees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So far this year, IBM’s stock has rallied thanks to strong investor interest in its growing software business. This momentum comes from IBM’s acquisitions of companies like Red Hat and HashiCorp. In addition, CEO Arvind Krishna has been pushing the software unit to become IBM’s biggest division, especially since the consulting side of the company has faced slower growth due to economic worries among customers.

It is worth noting that at the end of 2024, IBM had about 270,000 workers around the world. While the job cuts may impact some U.S.-based employees, the company expects that its total number of U.S. workers will stay roughly the same as last year. This suggests that the layoffs are part of a targeted restructuring strategy rather than widespread job reductions. Nevertheless, IBM shares are down at the time of writing.

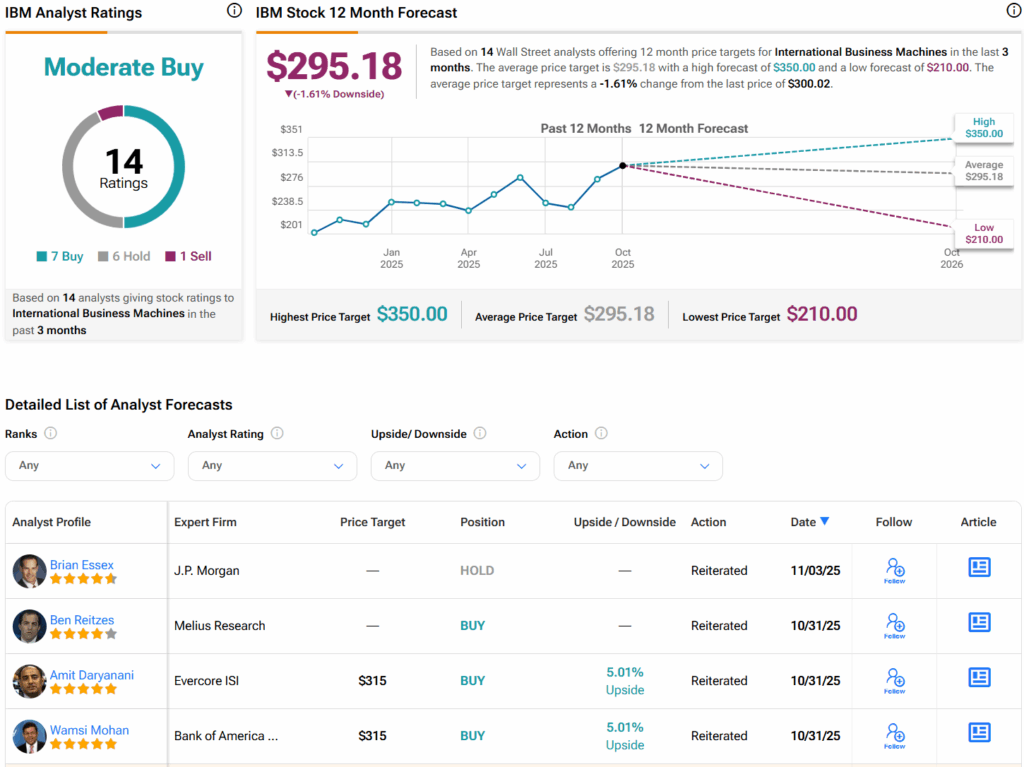

Is IBM a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on seven Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $295.18 per share implies 1.6% downside risk.