International Business Machines Corporation (IBM) is a global technology and IT consulting leader commonly known as Big Blue. It has a rich innovation history and has been at the forefront of technological evolution for over a century now. Recently, the company reported its fourth-quarter earnings for 2024, showcasing great results that attracted mass attention from investors. On Tipranks’ Smart Score, IBM stock passes with flying colors, scoring a rating of a perfect 10.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

First, I will briefly highlight IBM’s key data from yesterday’s report.

IBM’s Report Surprises Analysts

In Q4 2024, IBM reported earnings per share (EPS) of $3.92, surpassing analysts’ expectations of $3.78. The company’s revenue for the quarter was $17.55 billion, slightly above the anticipated $17.54 billion. This strong performance was driven by a 10% increase in software revenue, which now constitutes about 45% of IBM’s total revenue. However, the consulting and infrastructure segments saw 2% and 8% declines, respectively.

A Perfect 10

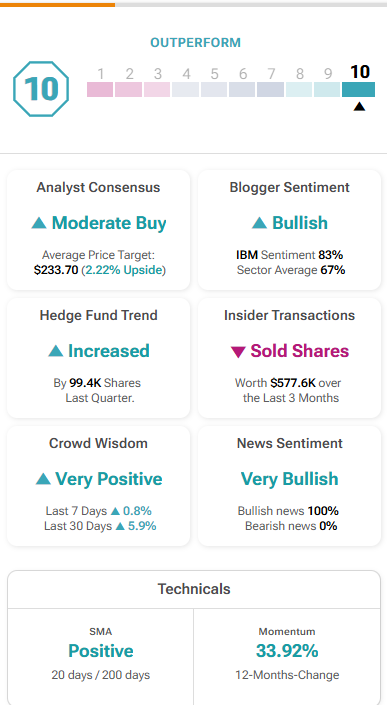

IBM’s stellar performance has earned it a perfect 10 on TipRanks’ Smart Score, which evaluates stocks based on eight key market factors, including analyst ratings, insider transactions, and news sentiment. A score of 10 indicates that IBM is expected to outperform the market, reflecting strong near-term prospects. This rating is a testament to IBM’s robust fundamentals and positive market sentiment.

Based on its recent success, IBM has set ambitious targets for 2025. The company aims for a revenue growth rate of at least 5% on a constant currency basis and expects to generate approximately $13.5 billion in free cash flow. These targets highlight IBM’s confidence in its strategic direction and growth potential.

The Drivers Behind IBM’s Success

A key driver of IBM’s future growth is its focus on artificial intelligence (AI) and quantum computing. IBM’s AI platform, watsonX, offers a comprehensive suite of tools for developing and deploying AI models. Additionally, IBM’s advancements in quantum computing, including its 100-qubit quantum processor launch, position the company at the cutting edge of technology.

IBM Solidifies Its Partnerships

IBM’s extensive collaborations with key tech companies further bolster its market position. Partnerships with industry giants like Amazon (AMZN), Nvidia (NVDA), and AMD (AMD) enhance IBM’s AI and cloud capabilities. These collaborations enable IBM to leverage the strengths of its partners and expand its market reach.

What Is IBM’s Price Target?

On Wall Street, IBM is considered a Moderate Buy. The price target of IBM stock is $233.70, implying a 2.22% upside potential.

Last (But Not Final) Word on IBM

IBM’s strong Q4 earnings, perfect TipRanks Smart Score, and strategic focus on AI and quantum computing highlight its promising prospects. With ambitious targets for 2025 and robust partnerships, IBM is well-positioned to continue its legacy well into the new year and keep its growth momentum.