American IT and consulting company IBM (IBM) is exiting two business lines in China, which undertook its research & development (R&D) operations, as disclosed in a virtual meeting this morning. This decision will affect the jobs of more than 1,000 employees. IBM and several other American tech companies are moving their operations out of China amid escalating geopolitical tensions with the U.S.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

IBM is shutting down its China Development Lab and China Systems Lab, which have operations spread across major cities such as Beijing and Shanghai. Interestingly, the company is considering shifting its R&D efforts to other places, including Bengaluru, India, where it is already hiring more engineers and researchers.

A spokesperson for IBM said that the decision was made keeping its clients’ best interests in mind. He added that the company will continue to support its Chinese clients across the Greater China region.

IBM and Peers Face Intense Competition in China

Over the past few years, IBM has witnessed pressure in its infrastructure business due to intense competition from domestic Chinese companies. In Fiscal 2023, IBM’s revenue from China fell by 19.6% year-over-year. Additionally, China sales declined by 5% year-over-year in the six months ending June 30, 2024.

China was seen as one of the largest markets for U.S. tech companies. However, the growing tensions between the U.S. and China have impacted growth opportunities in the mainland for American companies. The Chinese government is pushing consumers to buy tech services and products from domestic players.

Furthermore, stricter rules by U.S. regulators for companies doing business in China have compelled several players to shift focus to other regions. The U.S. administration is particularly critical about selling advanced AI (artificial intelligence) technology to China due to concerns that the latter might use it to strengthen its military capabilities.

Insights from TipRanks’ Bulls Say, Bears Say Tool

While IBM is facing headwinds in China, Bulls remain positive about several other aspects. According to TipRanks’ Bulls Say, Bears Say tool, analysts are optimistic about IBM’s foray into AI, machine learning, and hybrid cloud.

On the other hand, Bears are concerned about the rising competition that is impacting IBM’s sales and margins. Importantly, reduced IT spending by companies is impacting IBM’s consulting business.

Is IBM a Buy or Sell?

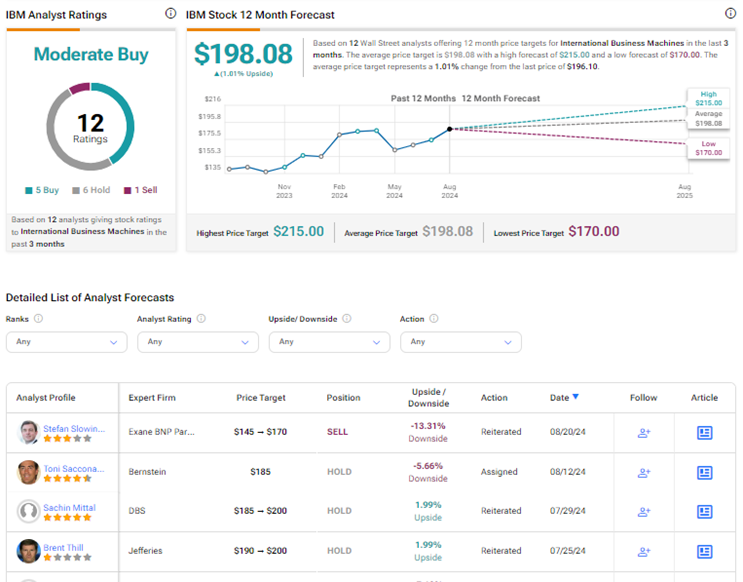

Wall Street remains divided on IBM stock’s trajectory. On TipRanks, IBM stock has a Moderate Buy consensus rating based on five Buys, six Holds, and one Sell rating. The average IBM price target of $198.08 implies just 1% upside potential from current levels. IBM shares have gained 23.3% year-to-date.