Tech company International Business Machines (IBM) announced in a blog post that its IBM Research and IBM Storage business units are teaming up to make storage systems “content aware,” which means that they will be able to automatically understand and process the data they hold. This shift could make it much easier for businesses to access and use their vast amounts of stored data, such as sales reports, manuals, and financial documents, that are currently trapped in formats AI can’t easily use.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Today’s common method, called retrieval-augmented generation (RAG), involves pulling data out of storage, converting it into searchable vectors, and storing it in a separate vector database. However, this creates challenges with security, data freshness, cost, and system complexity. To solve this, IBM is introducing content-aware storage (CAS), which combines data processing pipelines, vector databases, and compute systems directly into the storage platform.

Instead of acting as passive data containers, these new systems actively help with AI tasks like extracting data and embedding it for use in search or generative AI applications. CAS also improves security and performance by integrating access controls and processing triggers within the storage system itself, so vectors stay updated automatically. For search tasks, IBM is building scalable systems that can process up to 10 billion vectors in real time with 90% accuracy. This allows businesses to find rare and critical documents quickly.

What Is the Target Price for IBM?

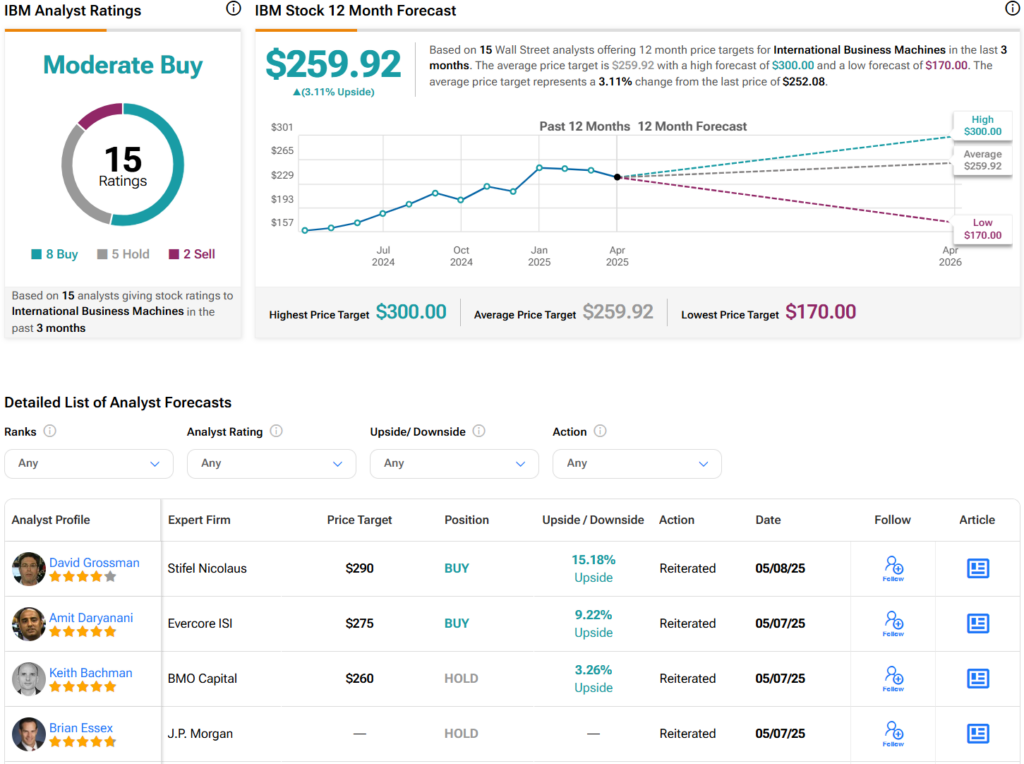

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on eight Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $259.92 per share implies 3.1% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue