The iShares Bitcoin ETF (IBIT) started the final week of the year in less than party mood. It is now down 2.91% over the last 5 days and off 6.48% in the year-to-date.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

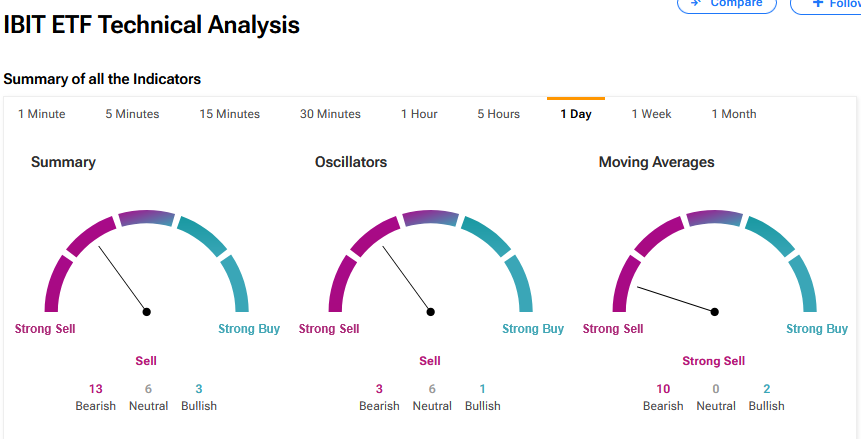

According to the IBIT’s technical analysis, it has a Sell consensus based on 13 Bearish, 6 Neutral and 3 Bullish ratings.

Based on the activity of 834,054 investors in the recent quarter, the IBIT has a below-sector-average Neutral investor sentiment. Overall, 1.8% of all portfolios hold the IBIT.

Today’s IBIT Performance

Today, the IBIT was down 0.14% at $49.54. The price of Bitcoin was off 0.43% at $87,498.87.

This is despite Strategy (MSTR) reporting that, between December 22 and December 28, 2025, it sold 663,450 shares of its MSTR Class A common stock, generating net proceeds of $108.8 million. It used that sum to acquire 1,229 bitcoin at an average price of $88,568 per BTC, bringing its total holdings as of December 28, 2025 to 672,497 bitcoin.

However, Cantor Fitzgerald said the price of bitcoin could be weak for the next few months. If bitcoin is in a “crypto winter,” it is 85 days into a peak-to-trough decline that typically lasts 365 days, the analyst told investors in a research note.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.